HarmoniAD Bridging Structure and Semantics for Precise Anomaly Detection

📝 Original Paper Info

- Title: HarmoniAD Harmonizing Local Structures and Global Semantics for Anomaly Detection- ArXiv ID: 2601.00327

- Date: 2026-01-01

- Authors: Naiqi Zhang, Chuancheng Shi, Jingtong Dou, Wenhua Wu, Fei Shen, Jianhua Cao

📝 Abstract

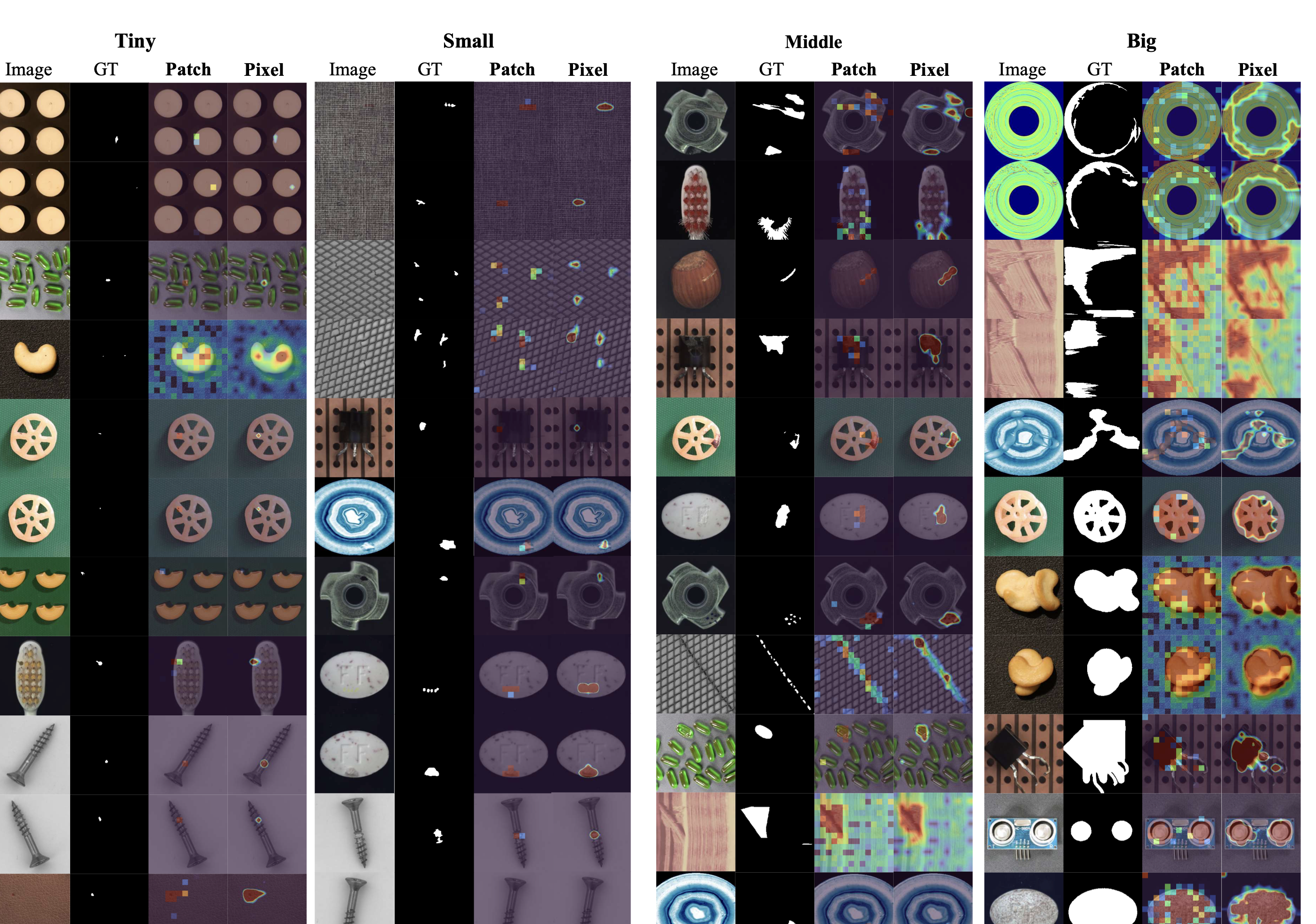

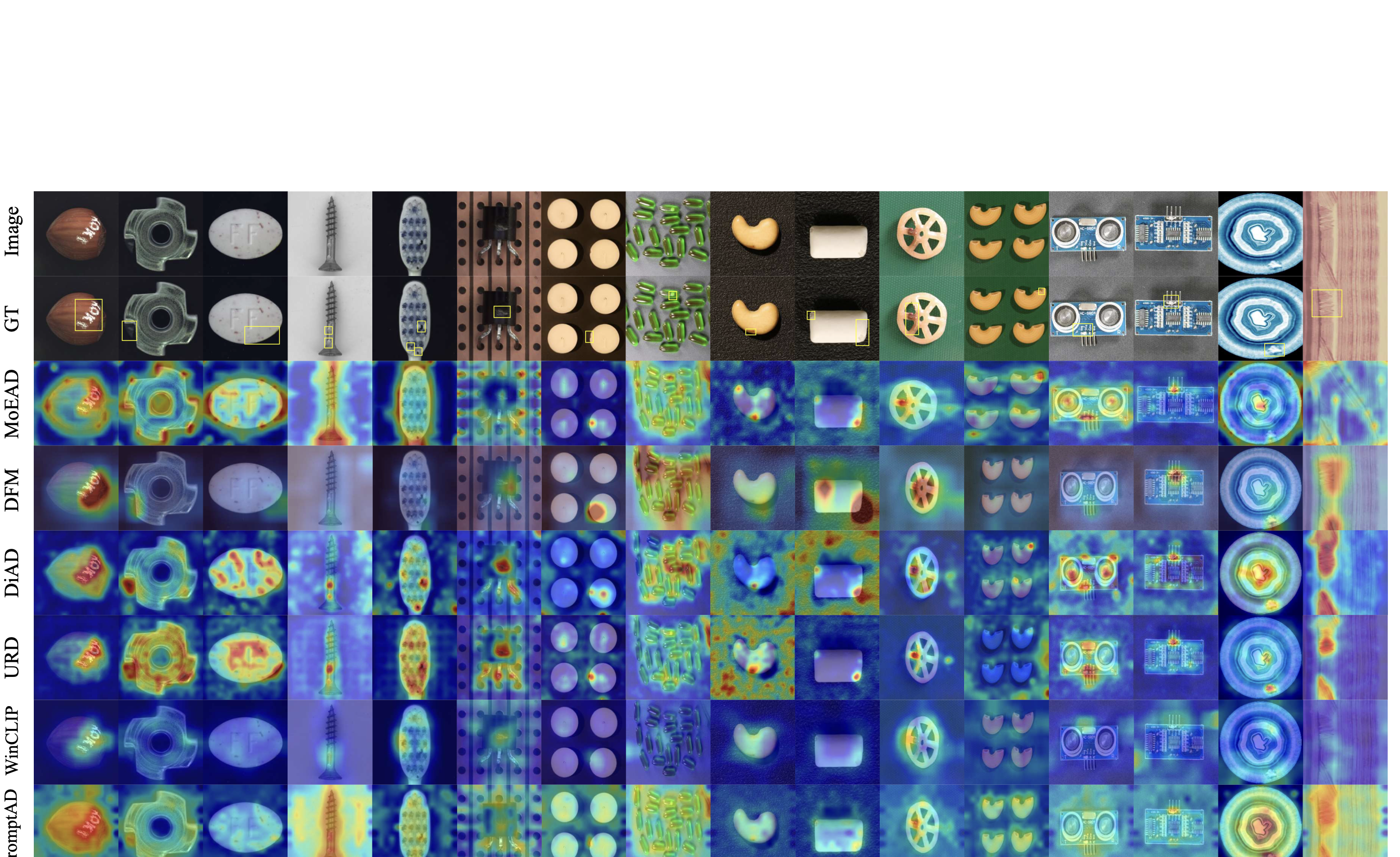

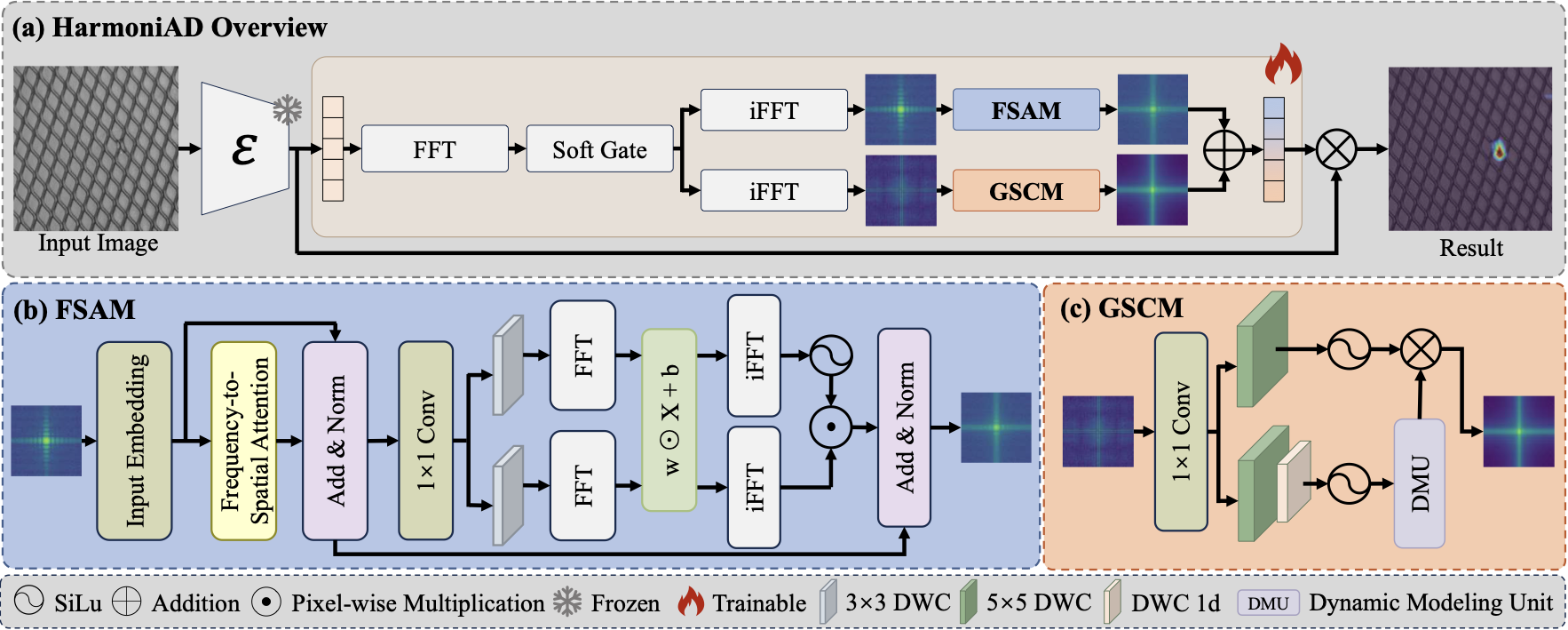

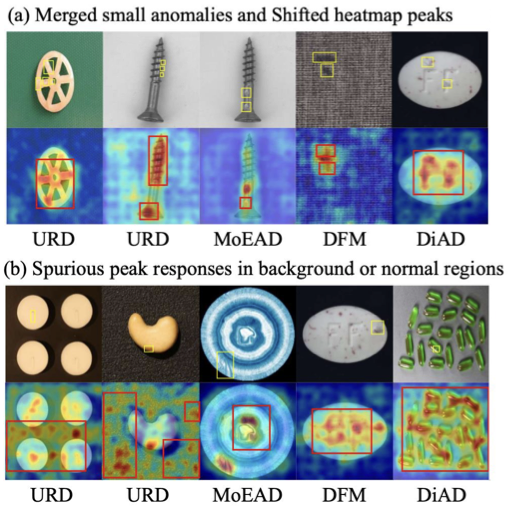

Anomaly detection is crucial in industrial product quality inspection. Failing to detect tiny defects often leads to serious consequences. Existing methods face a structure-semantics trade-off: structure-oriented models (such as frequency-based filters) are noise-sensitive, while semantics-oriented models (such as CLIP-based encoders) often miss fine details. To address this, we propose HarmoniAD, a frequency-guided dual-branch framework. Features are first extracted by the CLIP image encoder, then transformed into the frequency domain, and finally decoupled into high- and low-frequency paths for complementary modeling of structure and semantics. The high-frequency branch is equipped with a fine-grained structural attention module (FSAM) to enhance textures and edges for detecting small anomalies, while the low-frequency branch uses a global structural context module (GSCM) to capture long-range dependencies and preserve semantic consistency. Together, these branches balance fine detail and global semantics. HarmoniAD further adopts a multi-class joint training strategy, and experiments on MVTec-AD, VisA, and BTAD show state-of-the-art performance with both sensitivity and robustness.💡 Summary & Analysis

1. **Key Contribution 1:** Introduction of novel deep learning algorithms specifically tailored for financial time series. 2. **Key Contribution 2:** Comparative analysis with traditional statistical models. 3. **Key Contribution 3:** Real-world application demonstrating improved prediction accuracy in stock market trends.📄 Full Paper Content (ArXiv Source)

📊 논문 시각자료 (Figures)