PipeFlow Scalable Video Editing with Motion-Aware Frame Selection

📝 Original Paper Info

- Title: PipeFlow Pipelined Processing and Motion-Aware Frame Selection for Long-Form Video Editing- ArXiv ID: 2512.24026

- Date: 2025-12-30

- Authors: Mustafa Munir, Md Mostafijur Rahman, Kartikeya Bhardwaj, Paul Whatmough, Radu Marculescu

📝 Abstract

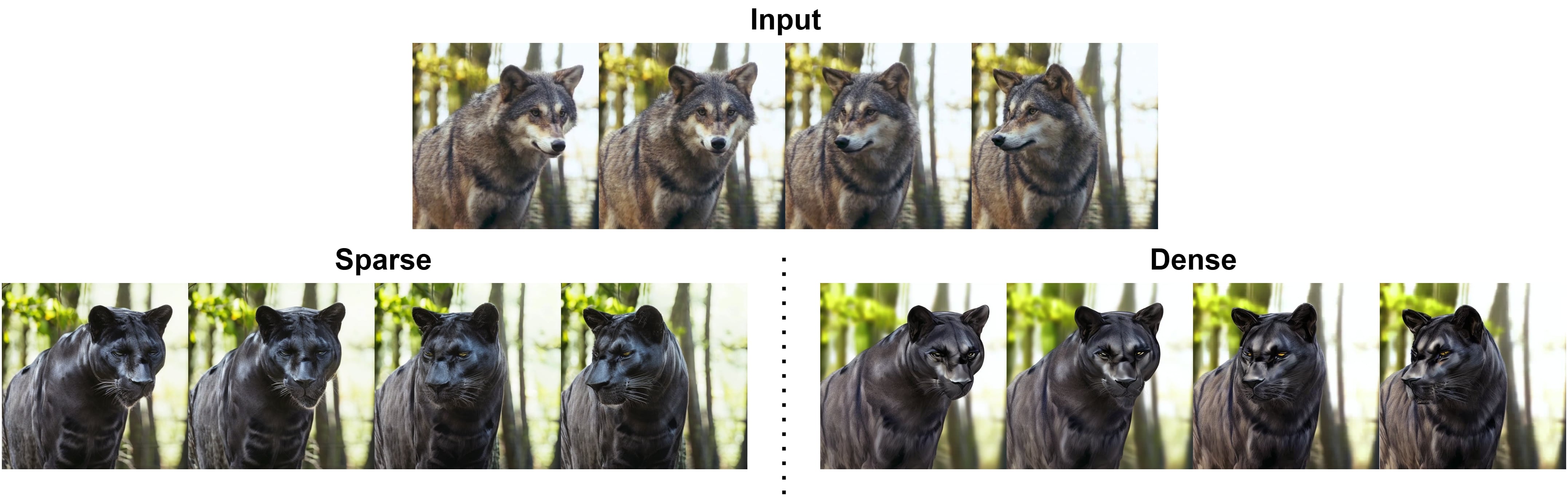

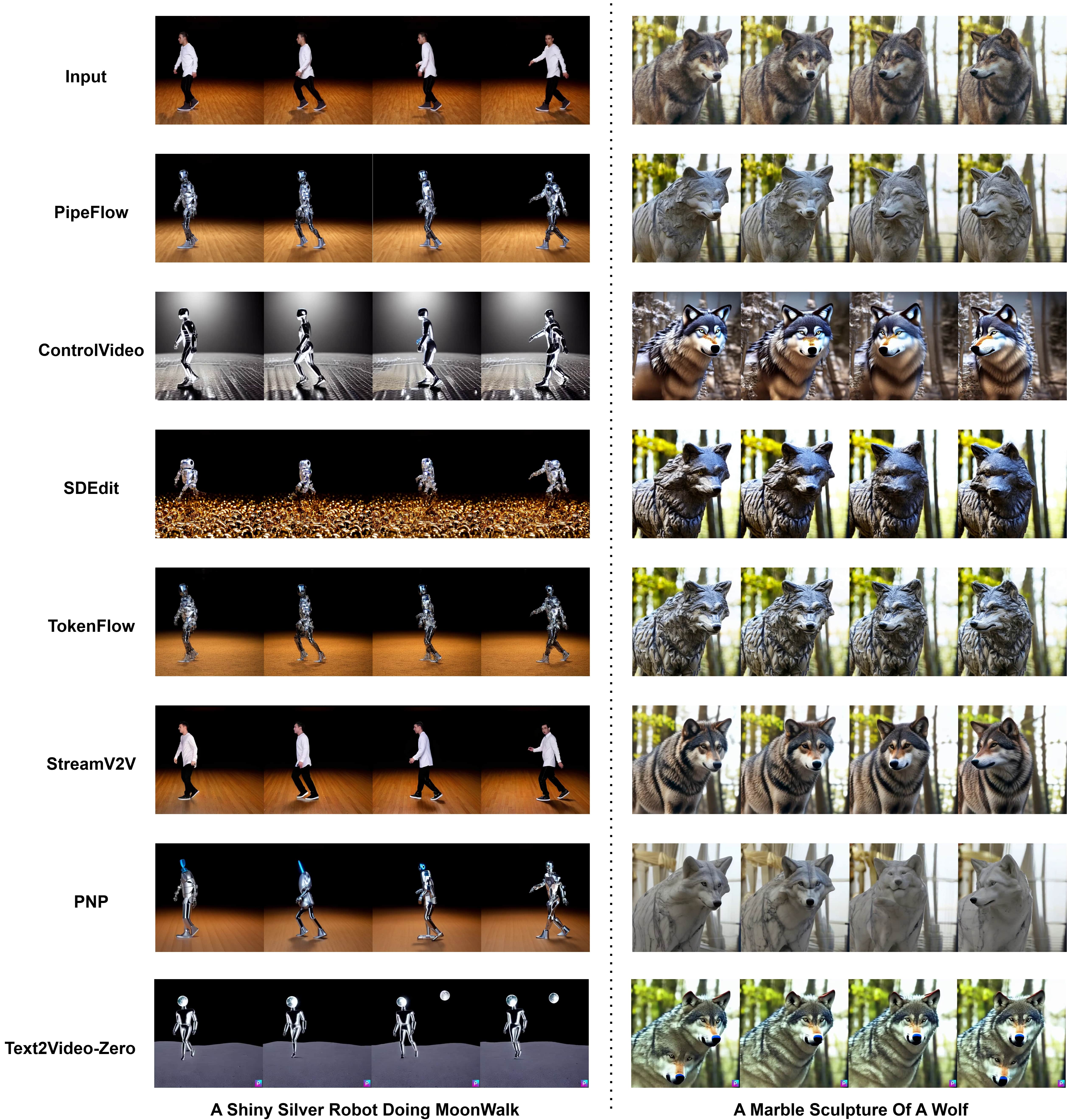

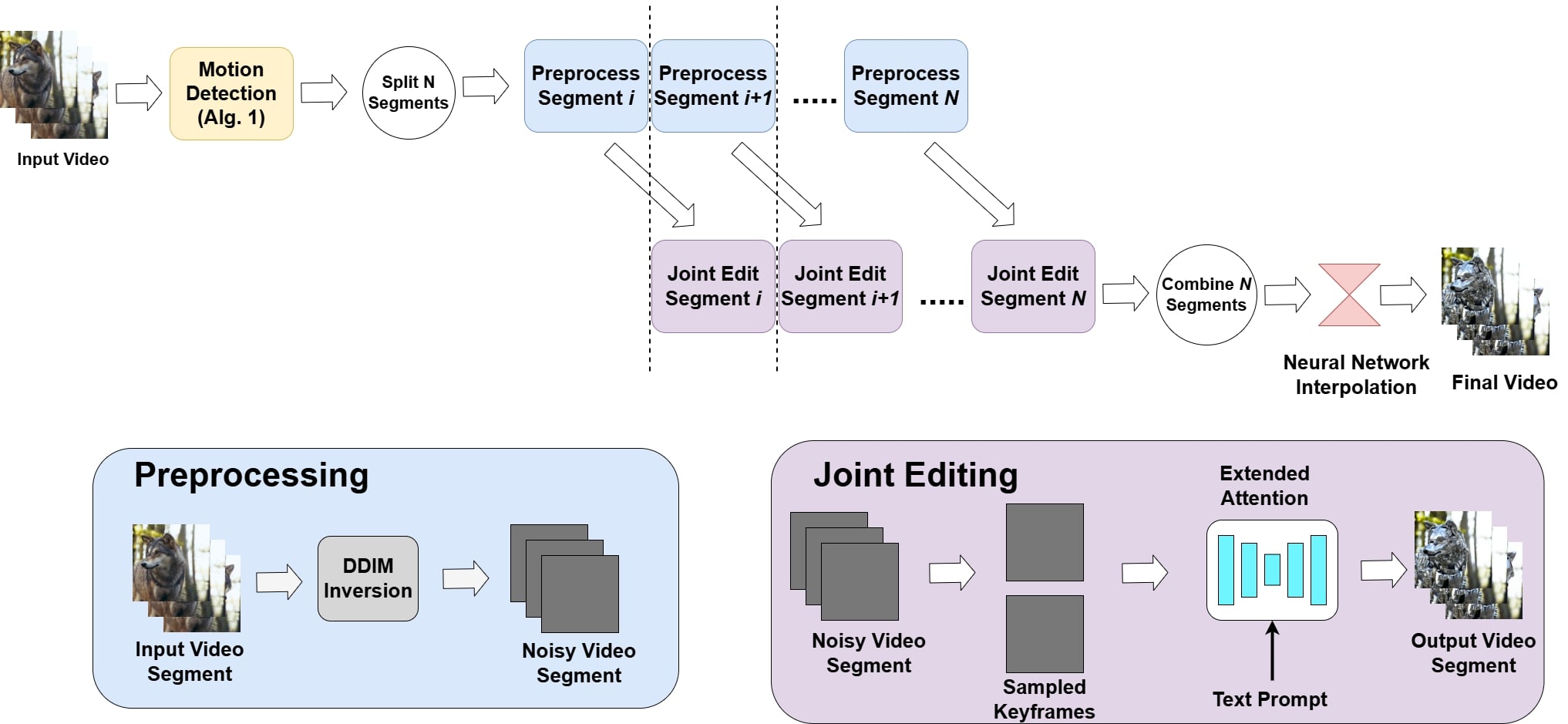

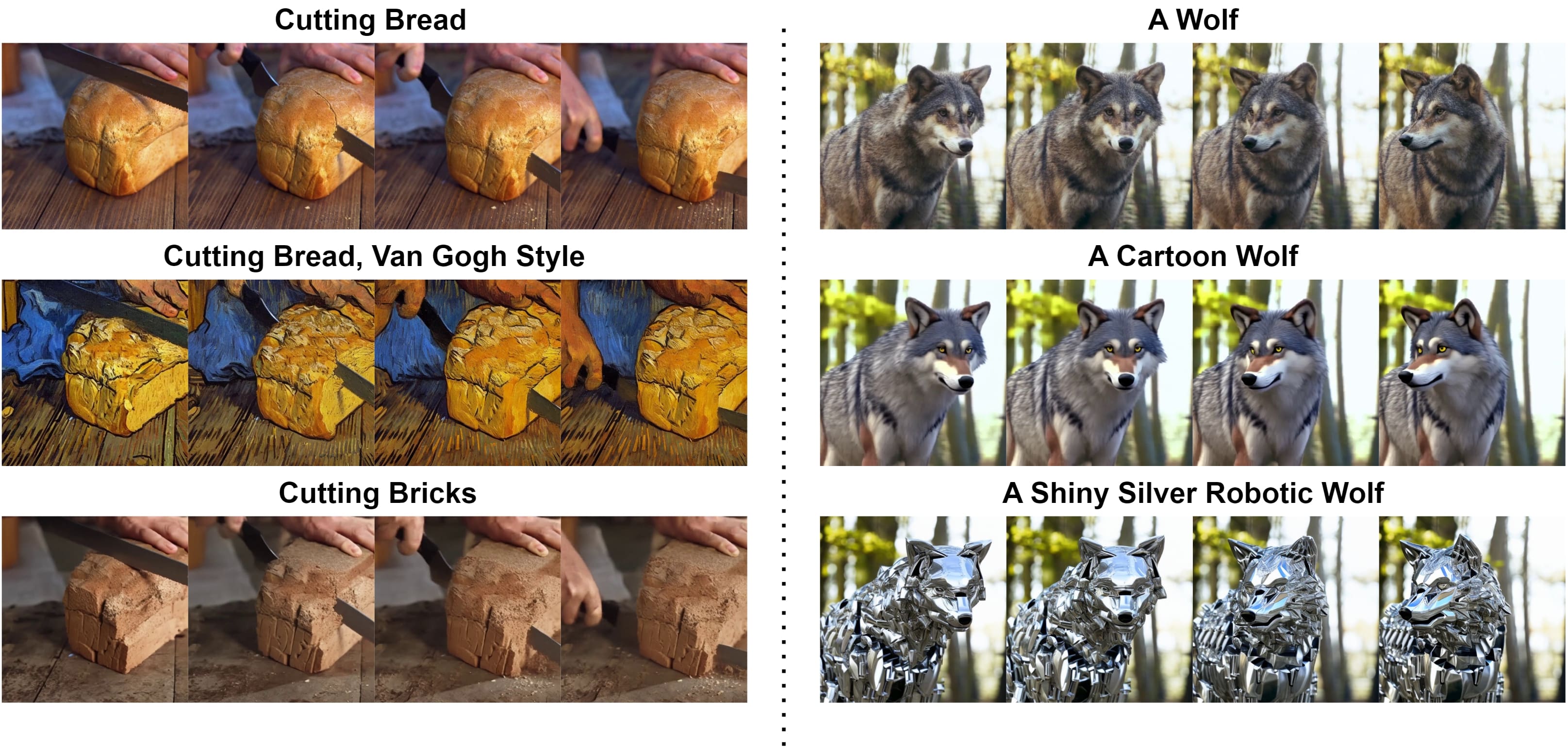

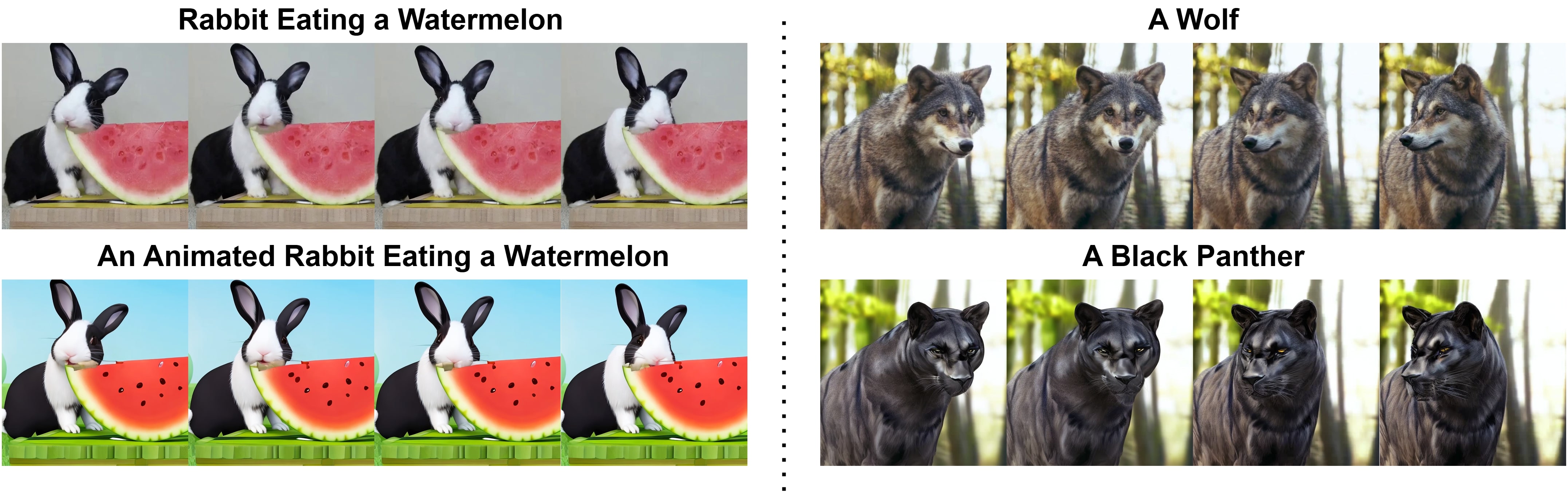

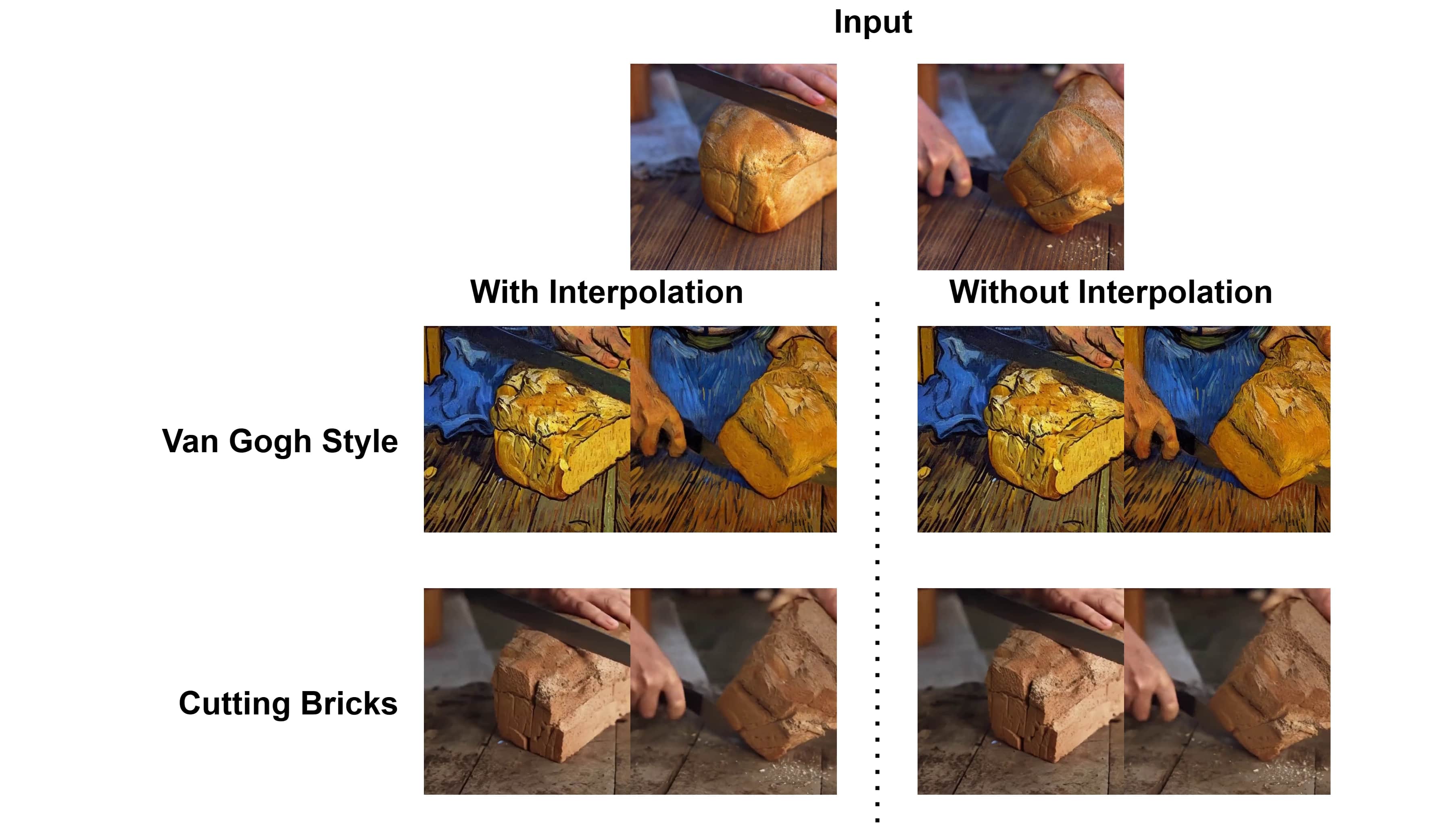

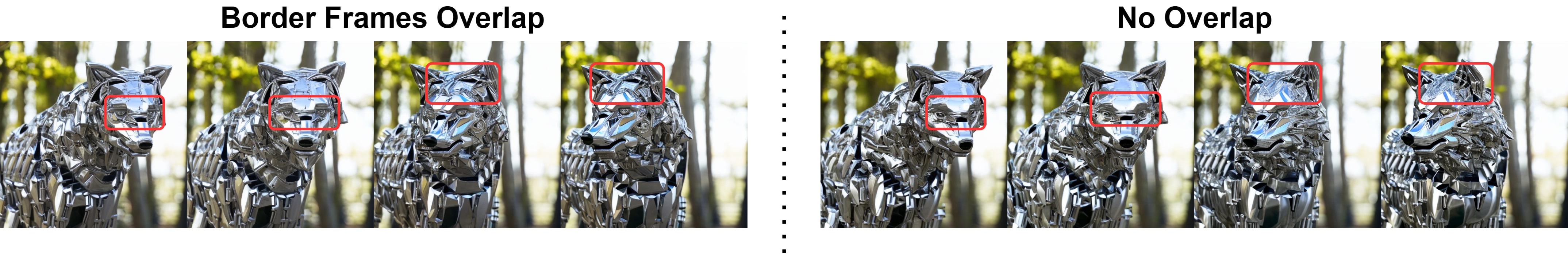

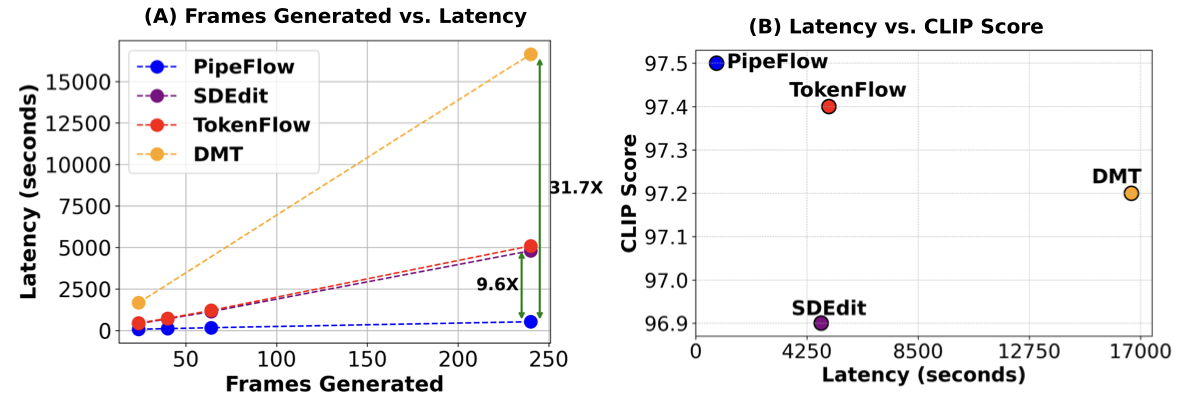

Long-form video editing poses unique challenges due to the exponential increase in the computational cost from joint editing and Denoising Diffusion Implicit Models (DDIM) inversion across extended sequences. To address these limitations, we propose PipeFlow, a scalable, pipelined video editing method that introduces three key innovations: First, based on a motion analysis using Structural Similarity Index Measure (SSIM) and Optical Flow, we identify and propose to skip editing of frames with low motion. Second, we propose a pipelined task scheduling algorithm that splits a video into multiple segments and performs DDIM inversion and joint editing in parallel based on available GPU memory. Lastly, we leverage a neural network-based interpolation technique to smooth out the border frames between segments and interpolate the previously skipped frames. Our method uniquely scales to longer videos by dividing them into smaller segments, allowing PipeFlow's editing time to increase linearly with video length. In principle, this enables editing of infinitely long videos without the growing per-frame computational overhead encountered by other methods. PipeFlow achieves up to a 9.6X speedup compared to TokenFlow and a 31.7X speedup over Diffusion Motion Transfer (DMT).💡 Summary & Analysis

1. **Machine Learning in Financial Market Prediction**: Machine learning algorithms can detect complex patterns and predict future prices more accurately than traditional methods, akin to having a heightened sense of perception in the dark. 2. **Advantages of Hybrid Models**: Combining random forests and support vector machines leverages their individual strengths, similar to forming an unbeatable team with two expert players. 3. **Performance Validation**: Demonstrating superior performance on historical data suggests promising future results. However, additional research and model refinement are necessary due to the unpredictable nature of real-world markets.📄 Full Paper Content (ArXiv Source)

📊 논문 시각자료 (Figures)