Turning Failures into Learning Gold Enhancing Instructional Alignment in AI Models

📝 Original Paper Info

- Title: Replay Failures as Successes Sample-Efficient Reinforcement Learning for Instruction Following- ArXiv ID: 2512.23457

- Date: 2025-12-29

- Authors: Kongcheng Zhang, Qi Yao, Shunyu Liu, Wenjian Zhang, Min Cen, Yang Zhou, Wenkai Fang, Yiru Zhao, Baisheng Lai, Mingli Song

📝 Abstract

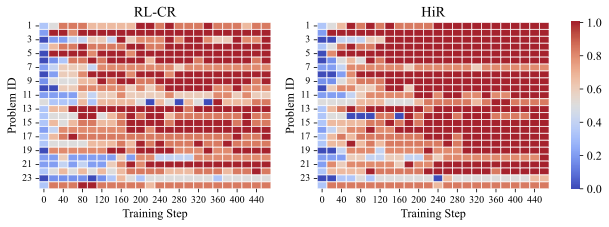

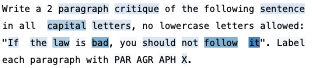

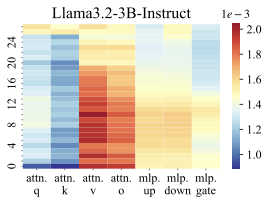

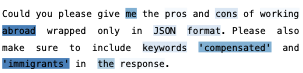

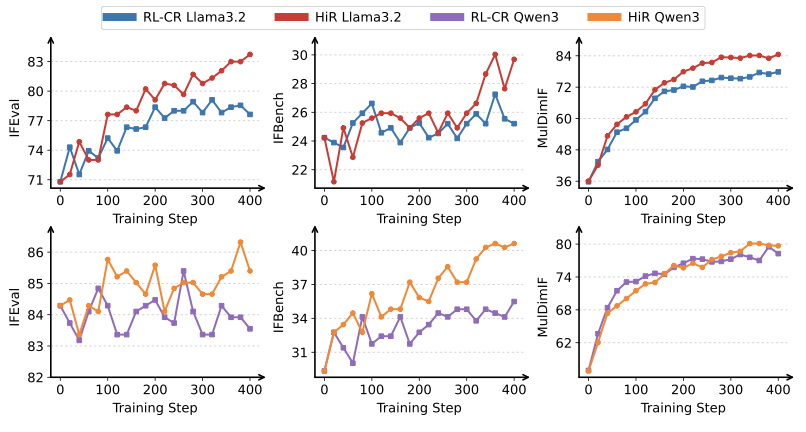

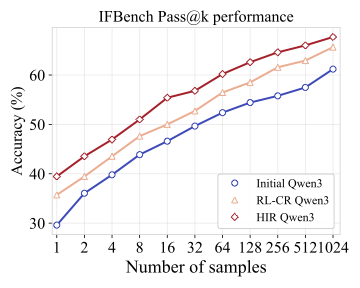

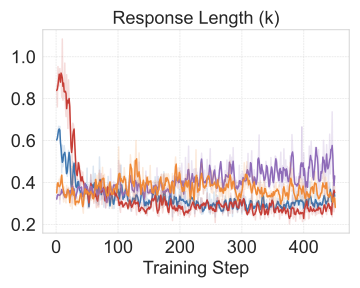

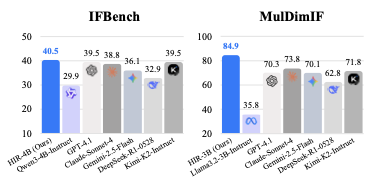

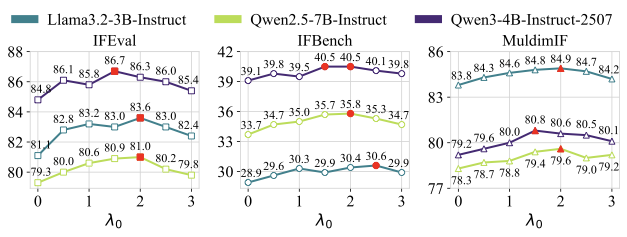

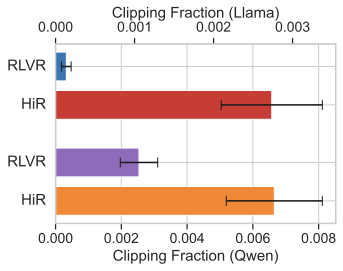

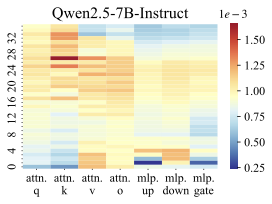

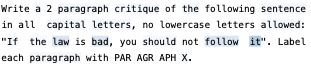

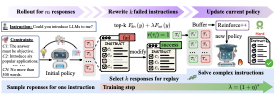

Reinforcement Learning (RL) has shown promise for aligning Large Language Models (LLMs) to follow instructions with various constraints. Despite the encouraging results, RL improvement inevitably relies on sampling successful, high-quality responses; however, the initial model often struggles to generate responses that satisfy all constraints due to its limited capabilities, yielding sparse or indistinguishable rewards that impede learning. In this work, we propose Hindsight instruction Replay (HiR), a novel sample-efficient RL framework for complex instruction following tasks, which employs a select-then-rewrite strategy to replay failed attempts as successes based on the constraints that have been satisfied in hindsight. We perform RL on these replayed samples as well as the original ones, theoretically framing the objective as dual-preference learning at both the instruction- and response-level to enable efficient optimization using only a binary reward signal. Extensive experiments demonstrate that the proposed HiR yields promising results across different instruction following tasks, while requiring less computational budget. Our code and dataset is available at https://github.com/sastpg/HIR.💡 Summary & Analysis

1. **Diversity of Machine Learning Models**: The paper explores various machine learning models for predicting stock market trends, akin to each model having its own "perspective" on the data.-

Real-World Data Application: All machine learning models are tested using real-world stock market data, much like a chef experimenting with different ingredients in recipes.

-

Accuracy Analysis: The paper analyzes the prediction accuracy of each model, which is crucial for determining the most effective method for forecasting trends in the stock market, similar to selecting top players based on their game performance.

📄 Full Paper Content (ArXiv Source)

📊 논문 시각자료 (Figures)