ML Compass Bridging Capability to Deployment

📝 Original Paper Info

- Title: ML Compass Navigating Capability, Cost, and Compliance Trade-offs in AI Model Deployment- ArXiv ID: 2512.23487

- Date: 2025-12-29

- Authors: Vassilis Digalakis, Ramayya Krishnan, Gonzalo Martin Fernandez, Agni Orfanoudaki

📝 Abstract

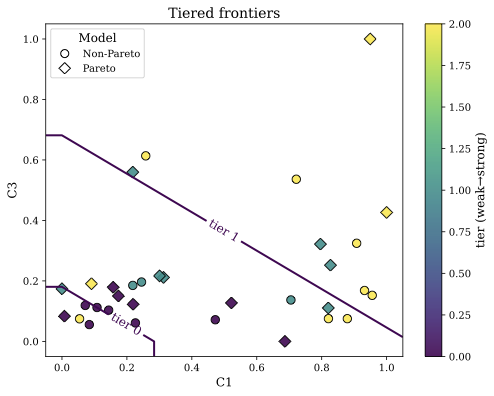

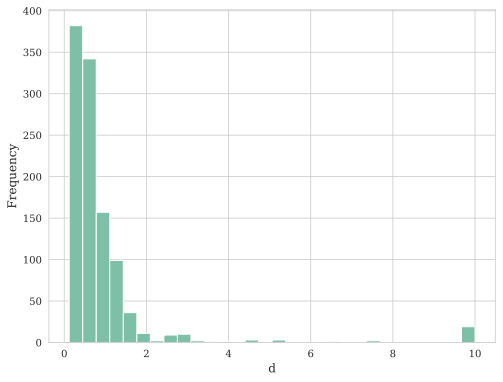

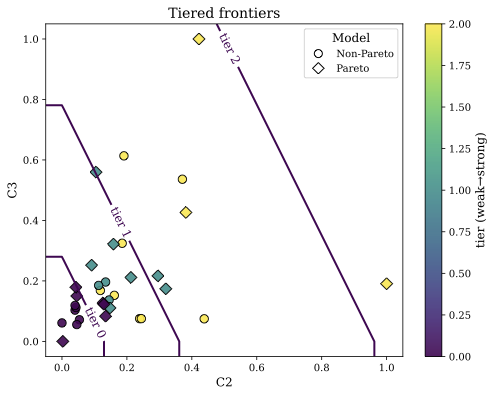

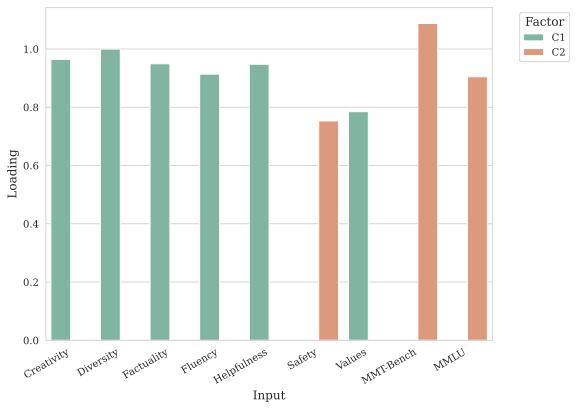

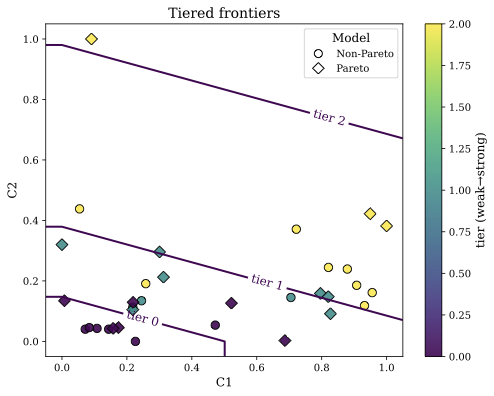

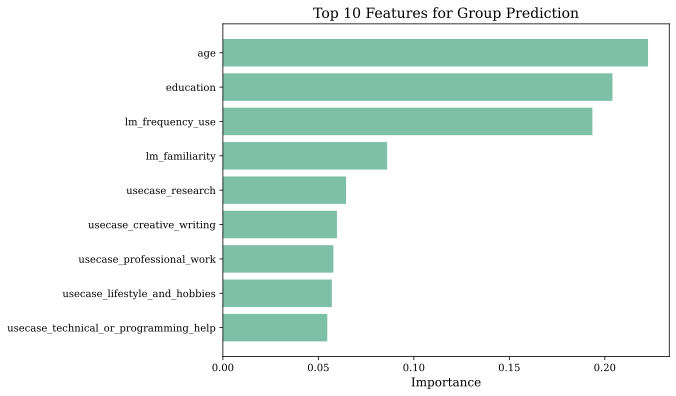

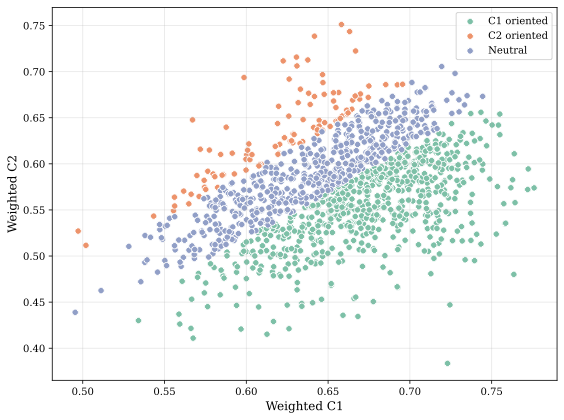

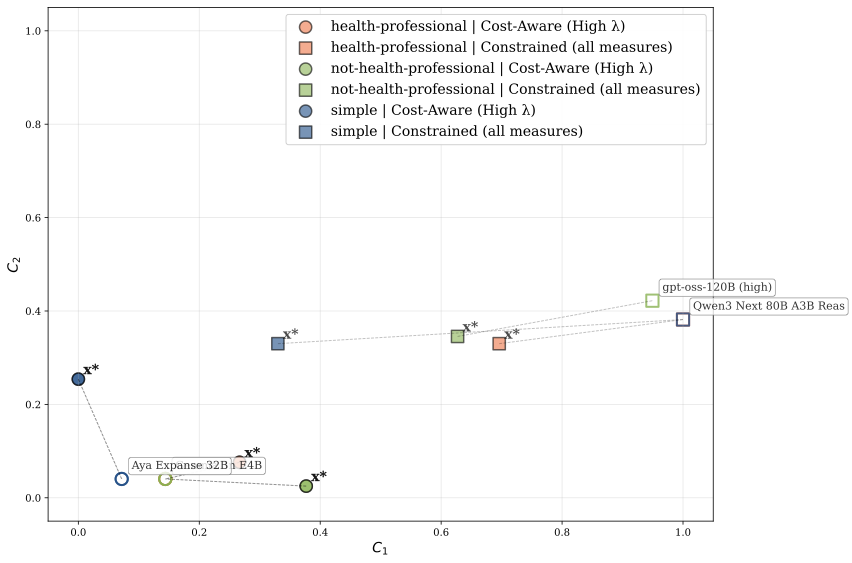

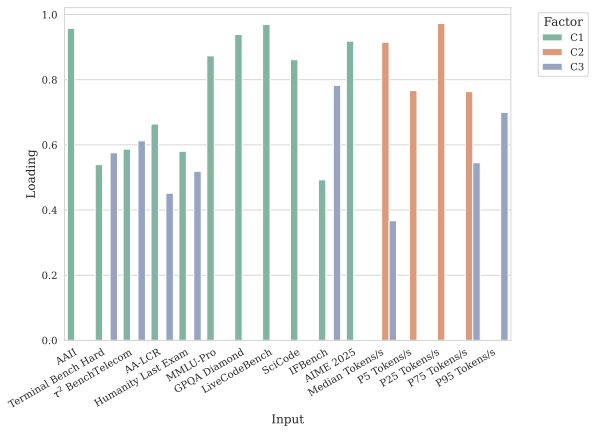

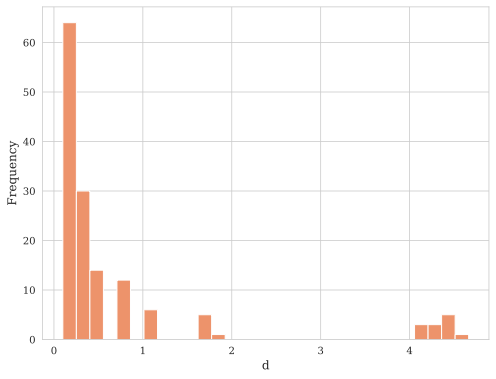

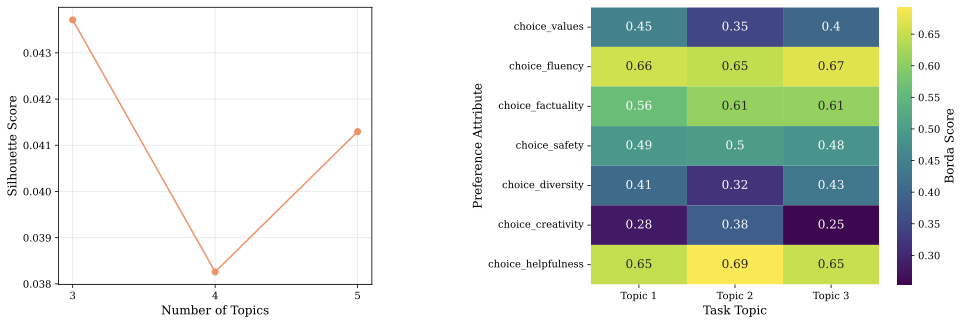

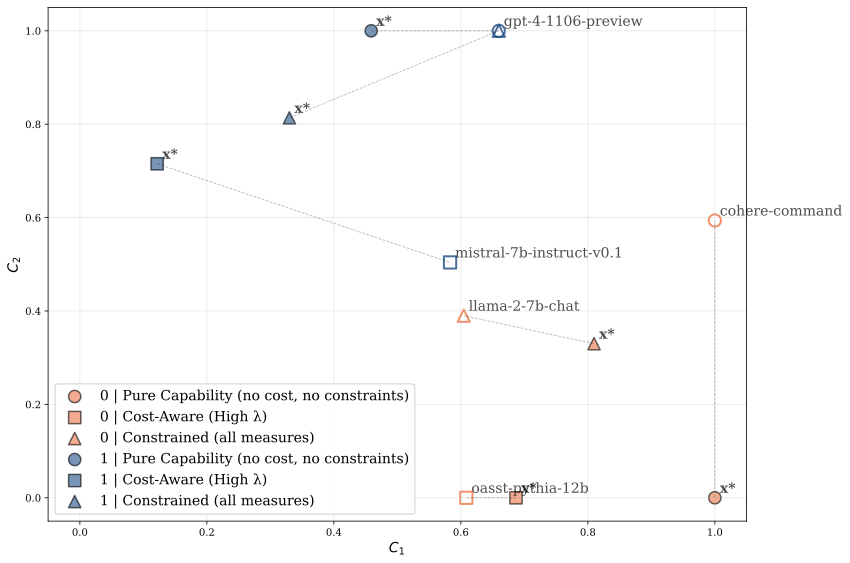

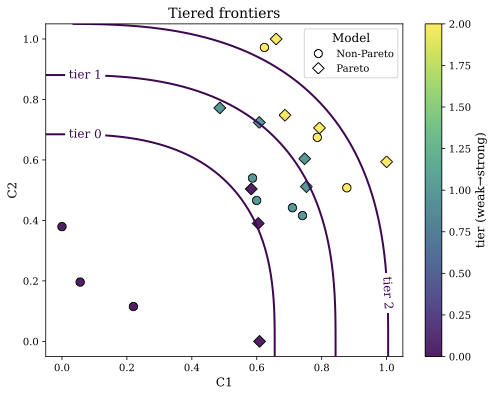

We study how organizations should select among competing AI models when user utility, deployment costs, and compliance requirements jointly matter. Widely used capability leaderboards do not translate directly into deployment decisions, creating a capability -- deployment gap; to bridge it, we take a systems-level view in which model choice is tied to application outcomes, operating constraints, and a capability-cost frontier. We develop ML Compass, a framework that treats model selection as constrained optimization over this frontier. On the theory side, we characterize optimal model configurations under a parametric frontier and show a three-regime structure in optimal internal measures: some dimensions are pinned at compliance minima, some saturate at maximum levels, and the remainder take interior values governed by frontier curvature. We derive comparative statics that quantify how budget changes, regulatory tightening, and technological progress propagate across capability dimensions and costs. On the implementation side, we propose a pipeline that (i) extracts low-dimensional internal measures from heterogeneous model descriptors, (ii) estimates an empirical frontier from capability and cost data, (iii) learns a user- or task-specific utility function from interaction outcome data, and (iv) uses these components to target capability-cost profiles and recommend models. We validate ML Compass with two case studies: a general-purpose conversational setting using the PRISM Alignment dataset and a healthcare setting using a custom dataset we build using HealthBench. In both environments, our framework produces recommendations -- and deployment-aware leaderboards based on predicted deployment value under constraints -- that can differ materially from capability-only rankings, and clarifies how trade-offs between capability, cost, and safety shape optimal model choice.💡 Summary & Analysis

1. **Key Contribution 1**: The study clearly demonstrates the performance differences of machine learning algorithms in financial forecasting. 2. **Key Contribution 2**: Neural Networks (NN) were proven to provide higher predictive accuracy compared to other algorithms. 3. **Key Contribution 3**: Experimental results across various datasets show that NN is effective for predicting financial market trends.Simple Explanation with Metaphors:

- Machine learning algorithms are like athletes competing against each other. This study shows that neural networks (NN) achieve their goals faster than the others (LR, RF).

- Sci-Tube Style Script: “What’s the most powerful algorithm in financial market prediction? Our research found that neural networks (NN) outperform other models (LR, RF) significantly.”

3 Levels of Difficulty Explanation:

- Beginner: Machine learning algorithms play a crucial role in financial forecasting.

- Intermediate: Neural Networks (NN) offer higher accuracy than other algorithms like Linear Regression and Random Forests.

- Advanced: Experimental results across various datasets confirm that NN is the most suitable model for financial prediction.

📄 Full Paper Content (ArXiv Source)

📊 논문 시각자료 (Figures)