RiskGuard RL Navigating High-Leverage Futures Trading

📝 Original Paper Info

- Title: FineFT Efficient and Risk-Aware Ensemble Reinforcement Learning for Futures Trading- ArXiv ID: 2512.23773

- Date: 2025-12-29

- Authors: Molei Qin, Xinyu Cai, Yewen Li, Haochong Xia, Chuqiao Zong, Shuo Sun, Xinrun Wang, Bo An

📝 Abstract

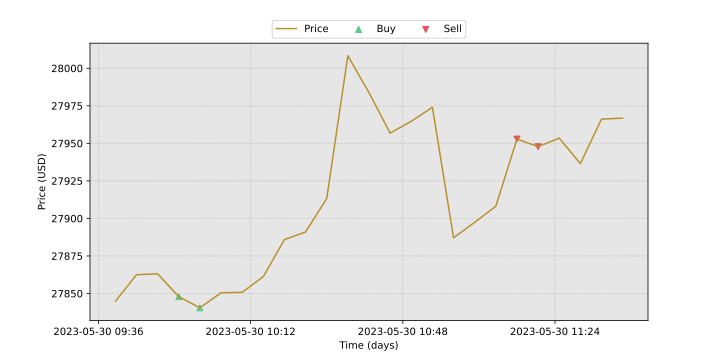

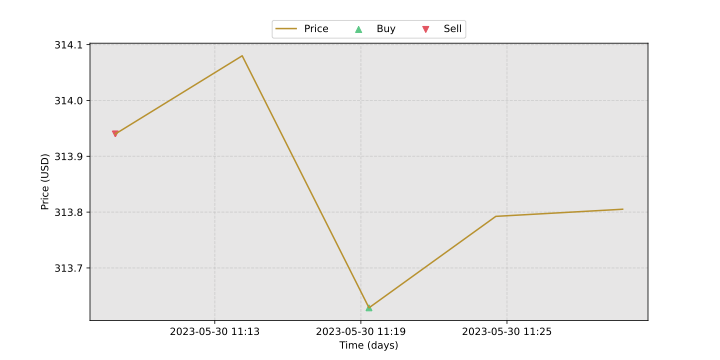

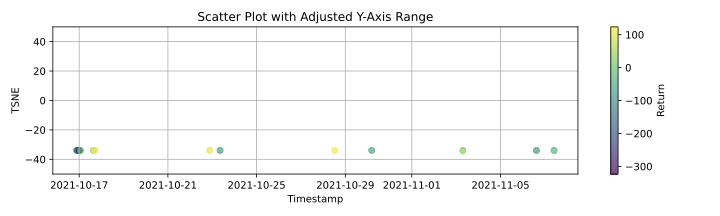

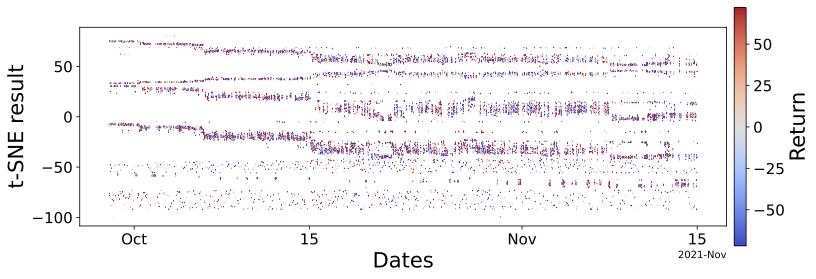

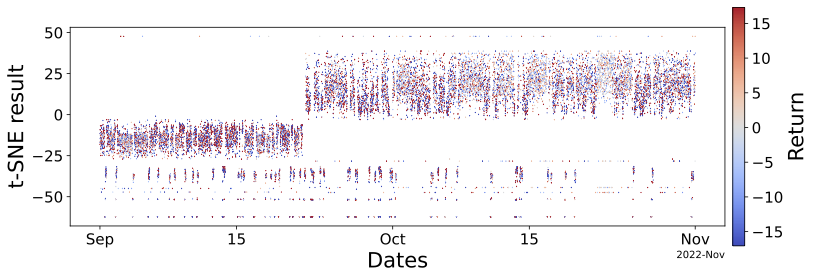

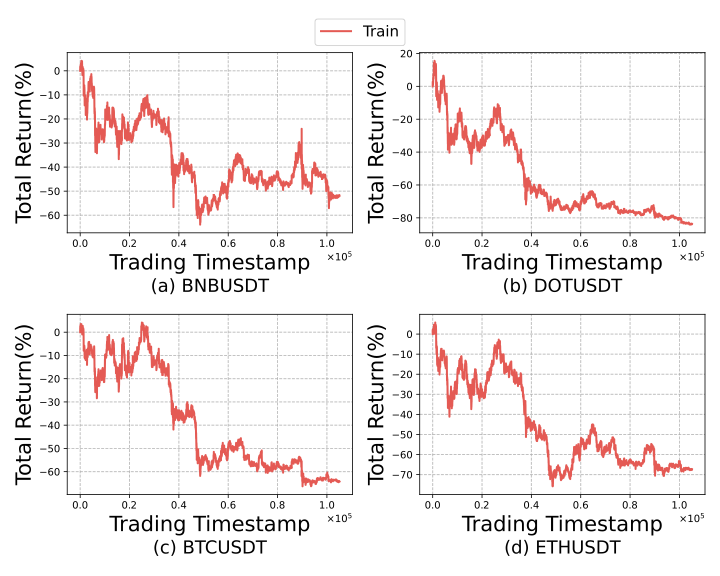

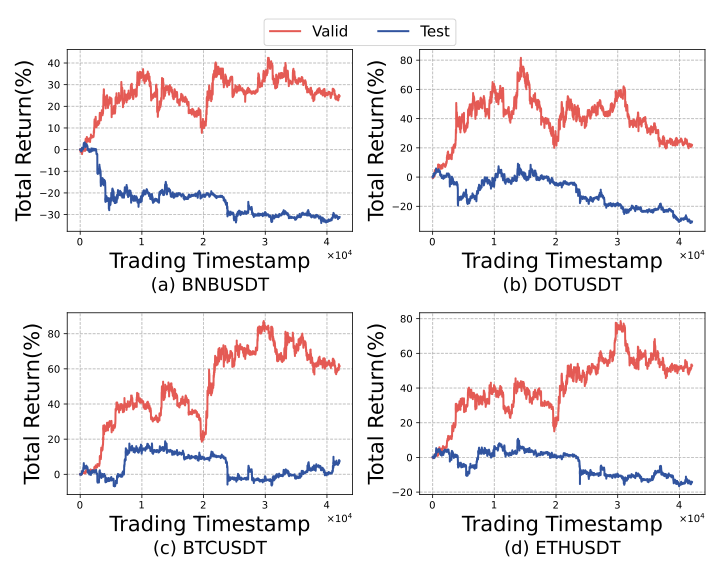

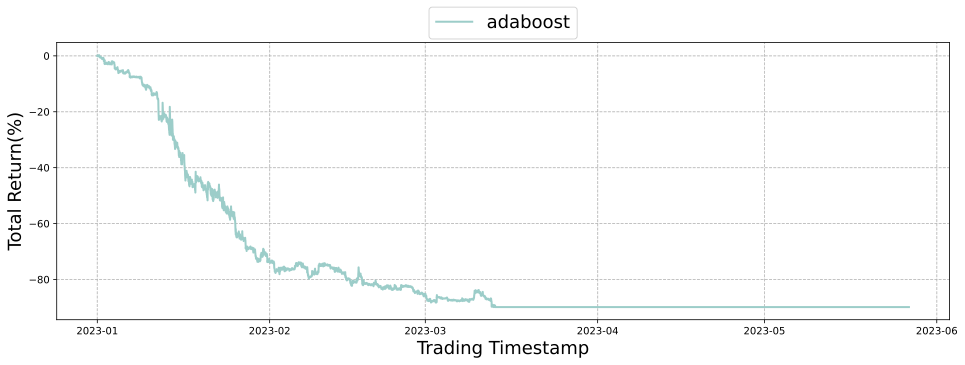

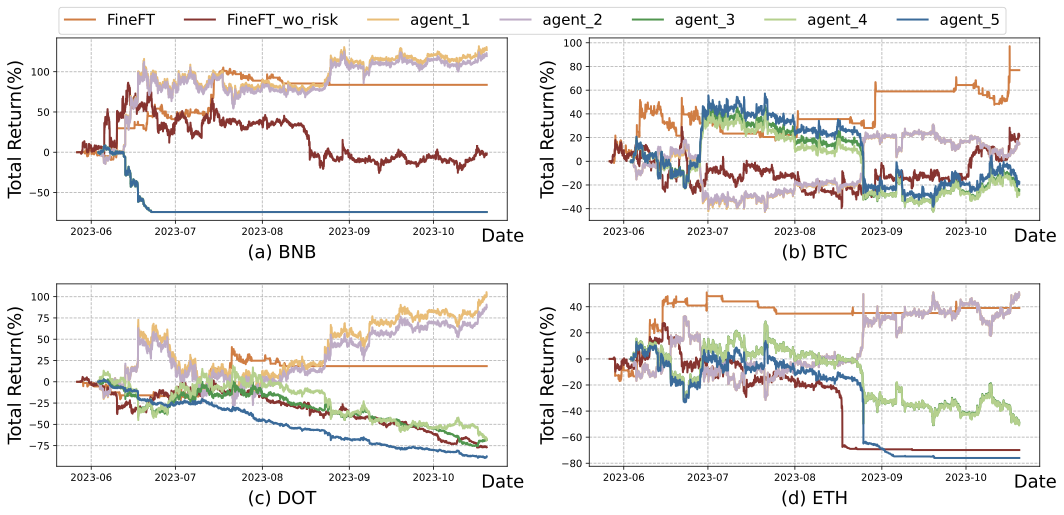

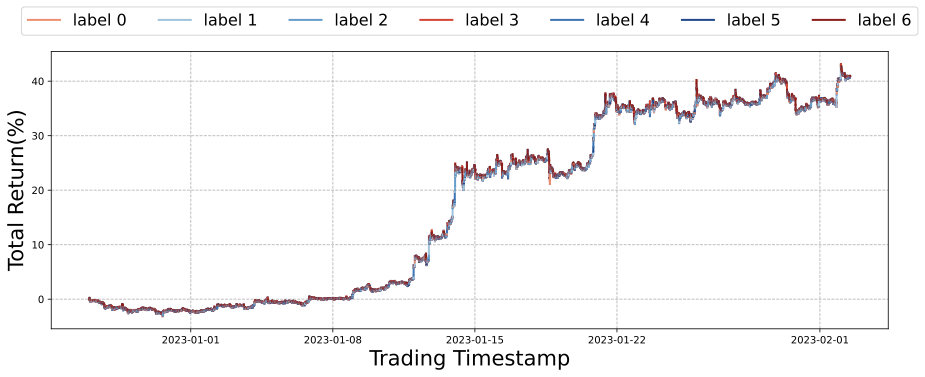

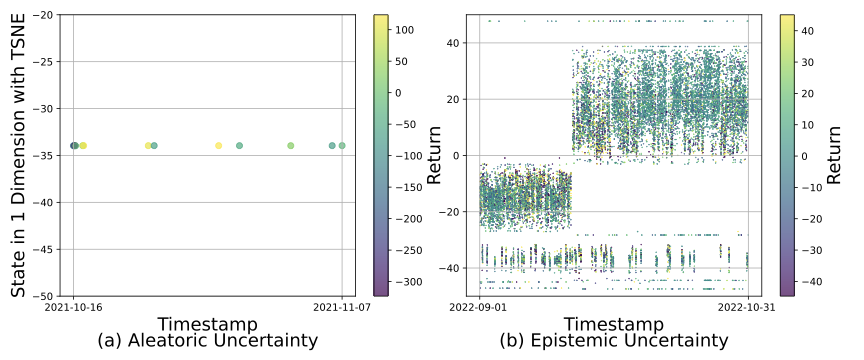

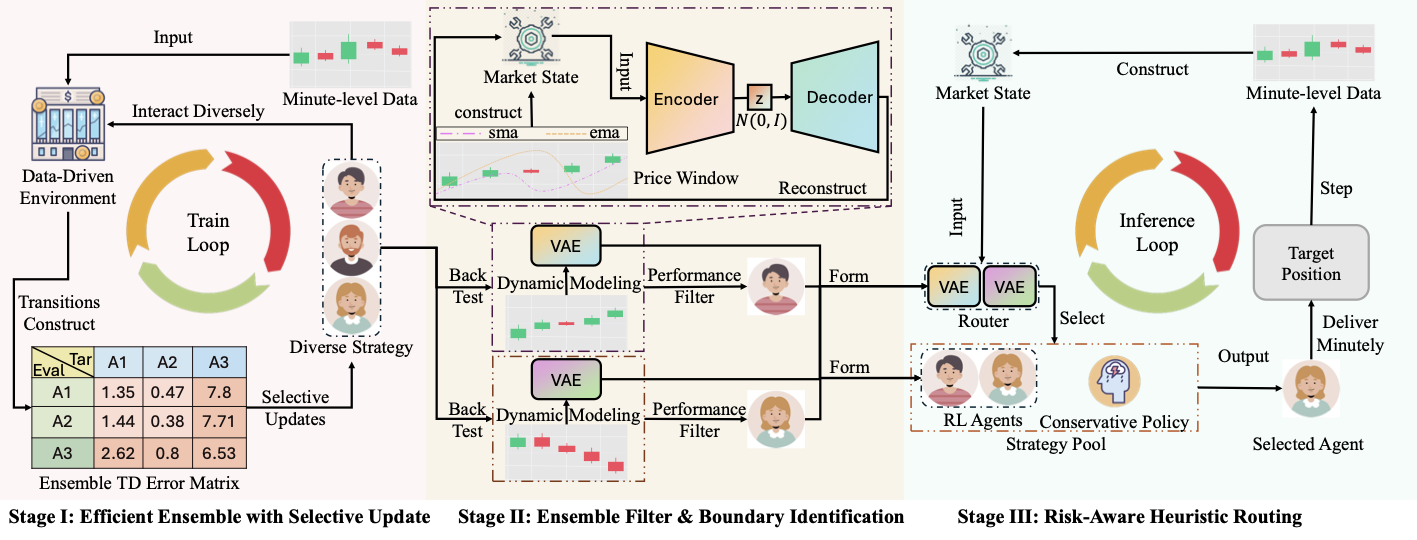

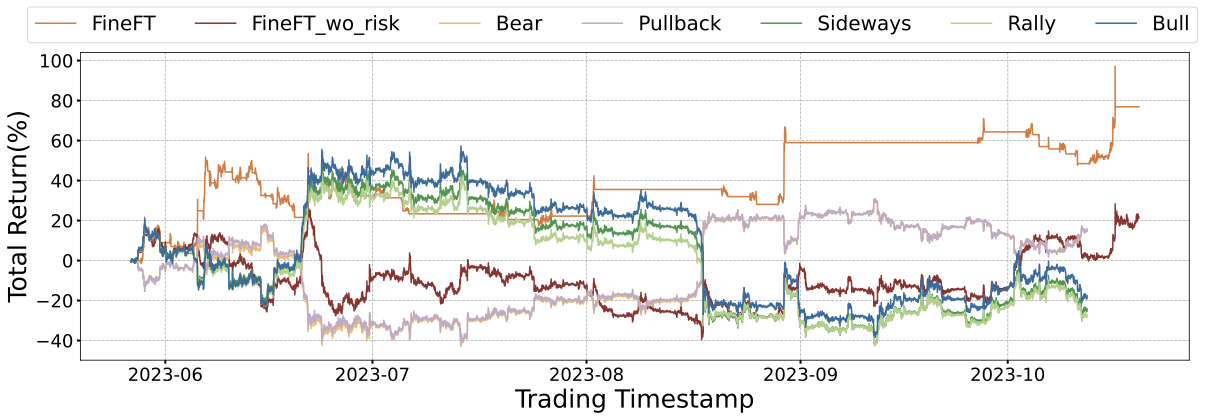

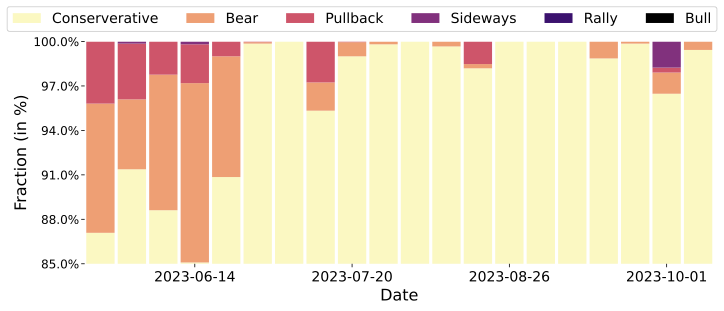

Futures are contracts obligating the exchange of an asset at a predetermined date and price, notable for their high leverage and liquidity and, therefore, thrive in the Crypto market. RL has been widely applied in various quantitative tasks. However, most methods focus on the spot and could not be directly applied to the futures market with high leverage because of 2 challenges. First, high leverage amplifies reward fluctuations, making training stochastic and difficult to converge. Second, prior works lacked self-awareness of capability boundaries, exposing them to the risk of significant loss when encountering new market state (e.g.,a black swan event like COVID-19). To tackle these challenges, we propose the Efficient and Risk-Aware Ensemble Reinforcement Learning for Futures Trading (FineFT), a novel three-stage ensemble RL framework with stable training and proper risk management. In stage I, ensemble Q learners are selectively updated by ensemble TD errors to improve convergence. In stage II, we filter the Q-learners based on their profitabilities and train VAEs on market states to identify the capability boundaries of the learners. In stage III, we choose from the filtered ensemble and a conservative policy, guided by trained VAEs, to maintain profitability and mitigate risk with new market states. Through extensive experiments on crypto futures in a high-frequency trading environment with high fidelity and 5x leverage, we demonstrate that FineFT outperforms 12 SOTA baselines in 6 financial metrics, reducing risk by more than 40% while achieving superior profitability compared to the runner-up. Visualization of the selective update mechanism shows that different agents specialize in distinct market dynamics, and ablation studies certify routing with VAEs reduces maximum drawdown effectively, and selective update improves convergence and performance.💡 Summary & Analysis

1. **Development of New Algorithms:** The paper introduces new learning methods in the field of artificial intelligence, similar to creating a new tool for more efficient work. 2. **Diversity of Datasets:** By utilizing diverse datasets, it evaluates and optimizes algorithm performance, leading to algorithms suitable for various scenarios. 3. **Importance of Transfer Learning:** Transfer learning techniques apply existing models to new problems, akin to adapting culinary skills learned in another city to local cuisine.Sci-Tube Style Script

- Beginner Level: “This paper introduces new tools to better understand artificial intelligence learning methods.”

- Intermediate Level: “It explores how to test algorithm performance using various datasets and optimize them through transfer learning techniques.”

- Advanced Level: “The paper compares four major algorithms to maximize the efficiency of AI learning, evaluating their performance with transfer learning.”

📄 Full Paper Content (ArXiv Source)

📊 논문 시각자료 (Figures)