Visualizing Value Deep Learning in Art Market Prediction

📝 Original Paper Info

- Title: Deep Learning for Art Market Valuation- ArXiv ID: 2512.23078

- Date: 2025-12-28

- Authors: Jianping Mei, Michael Moses, Jan Waelty, Yucheng Yang

📝 Abstract

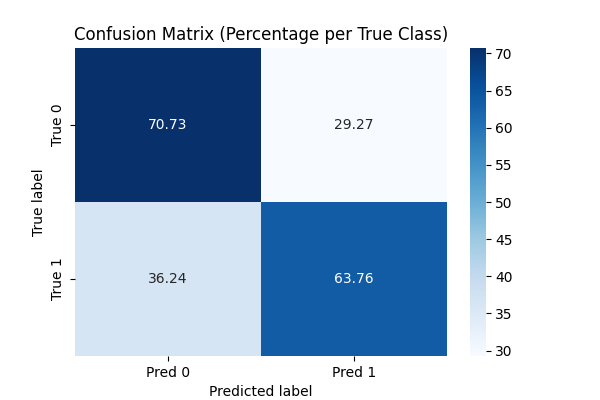

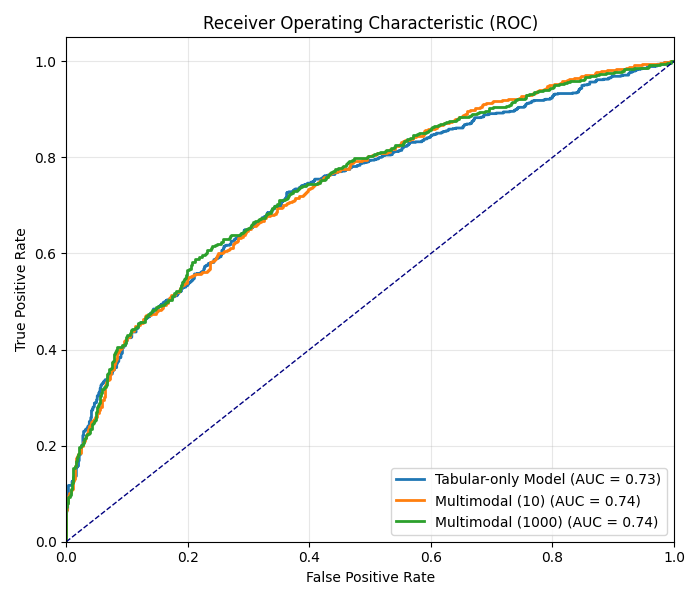

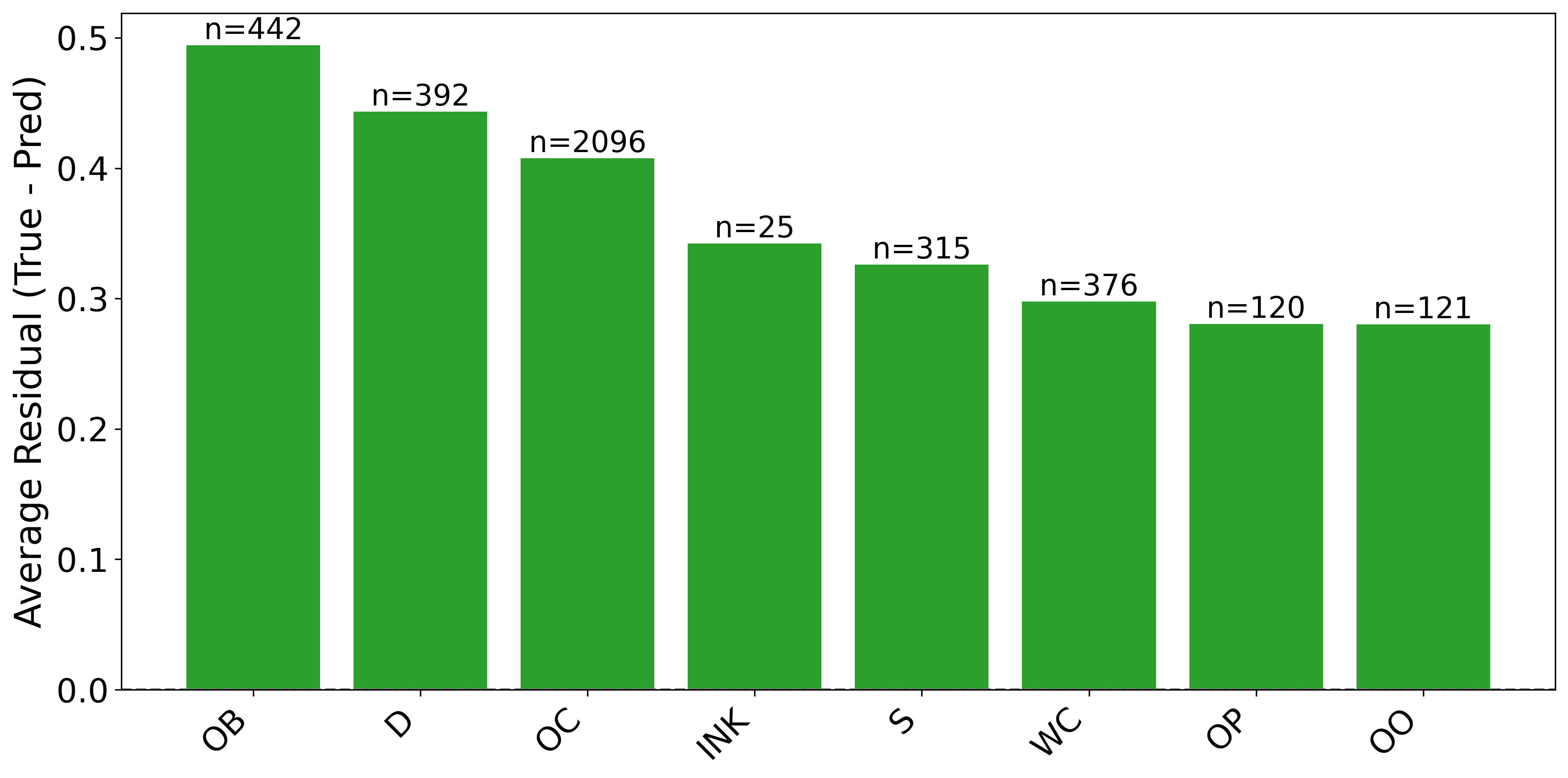

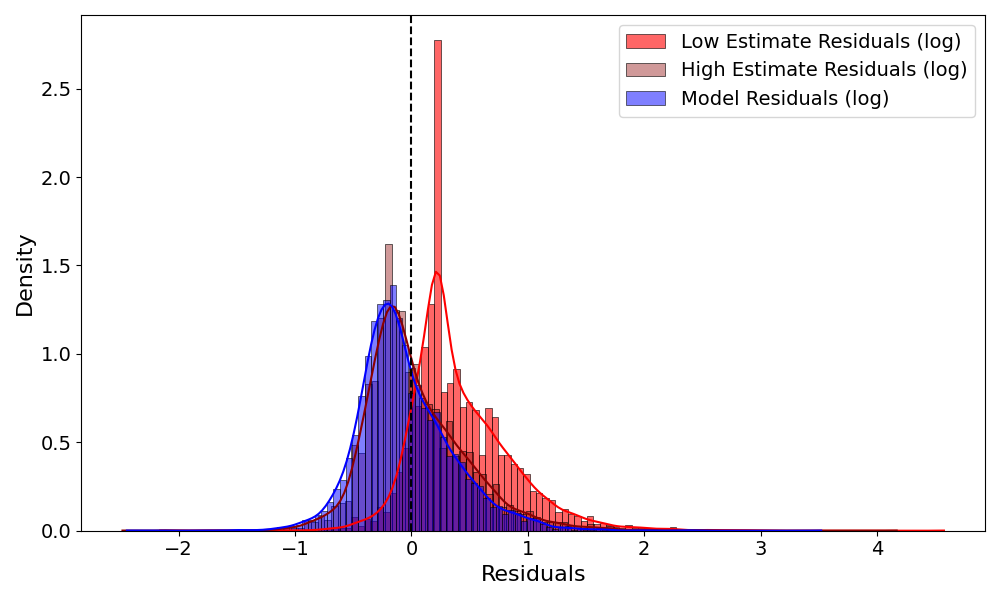

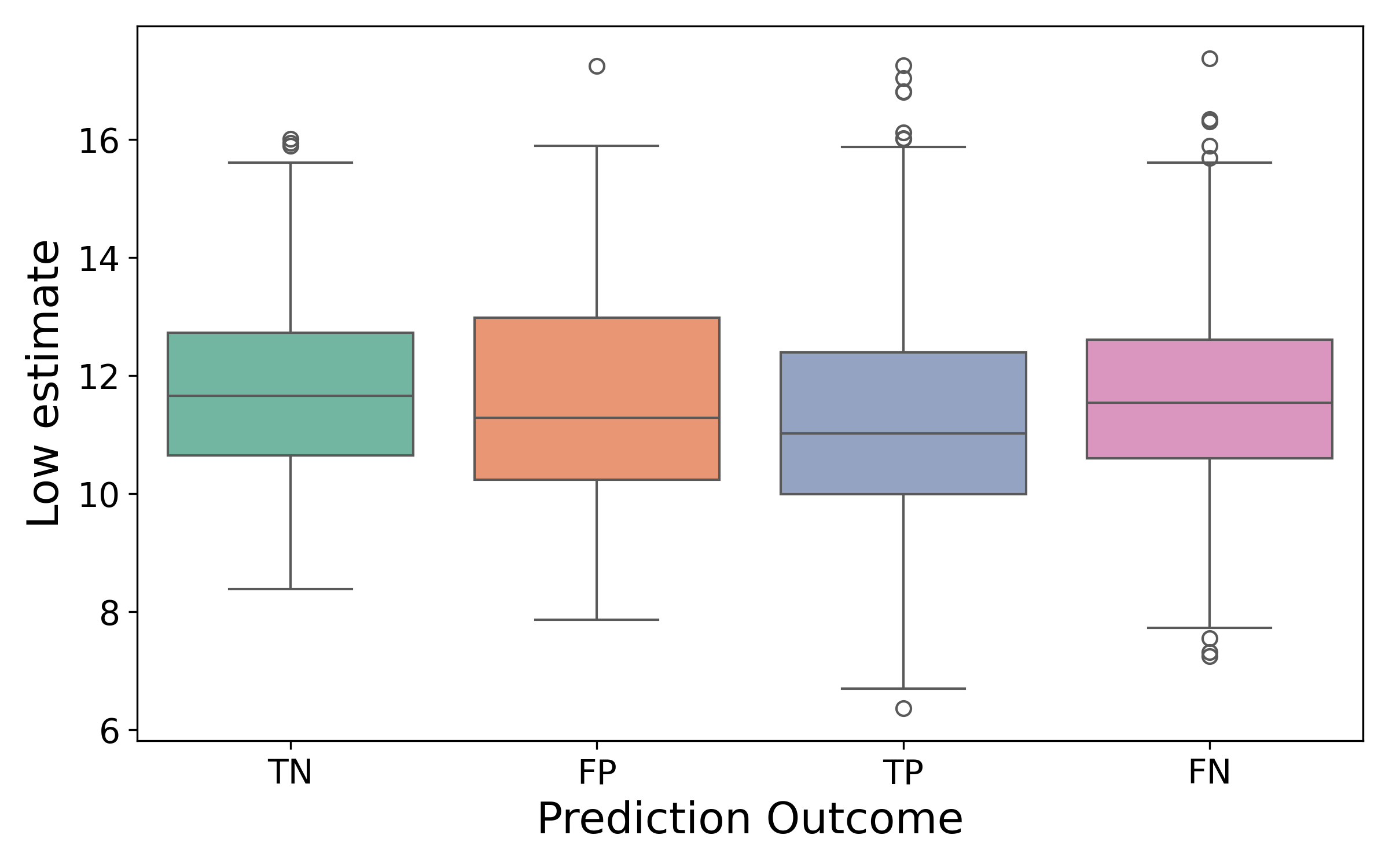

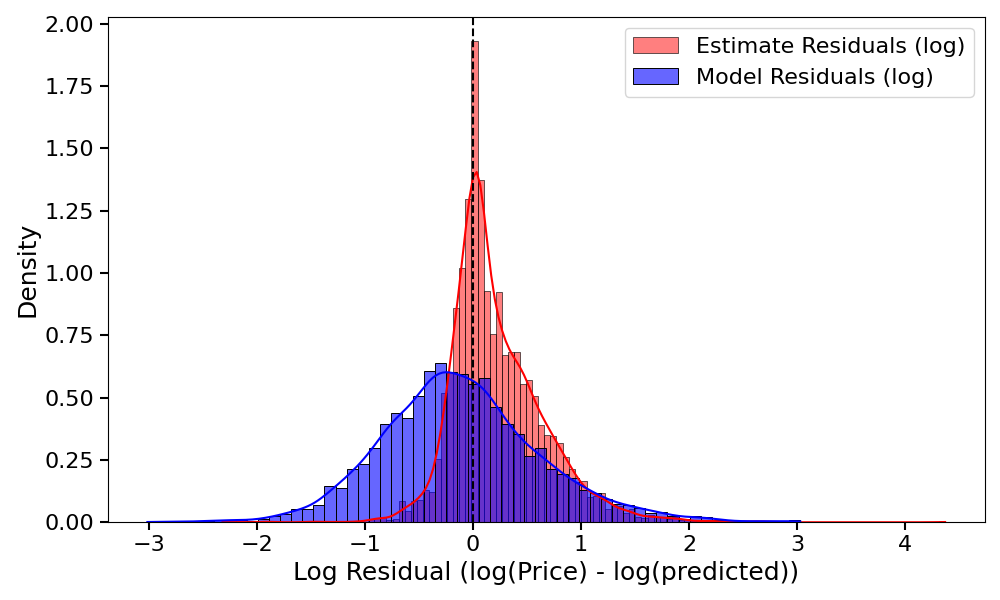

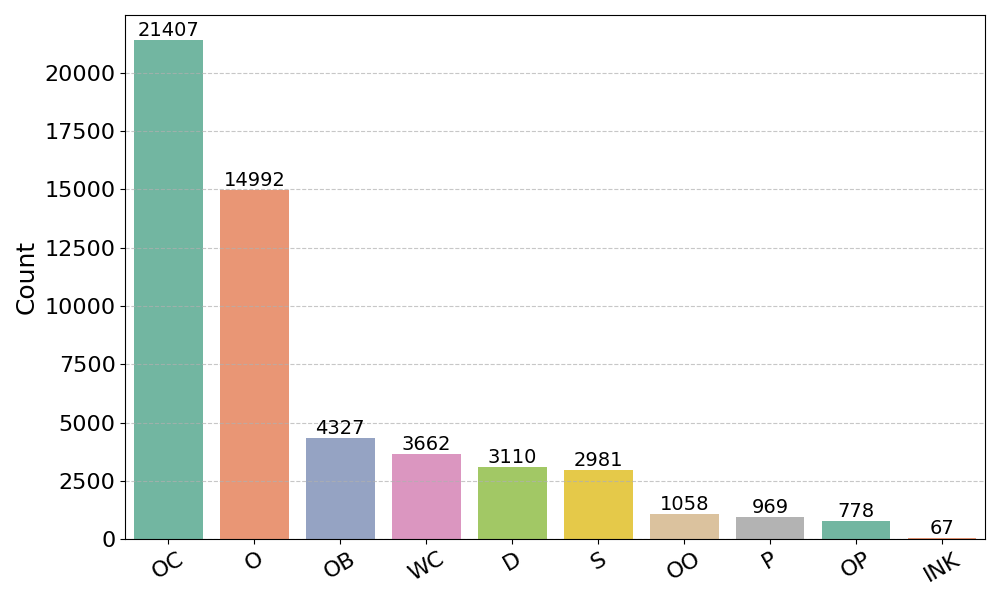

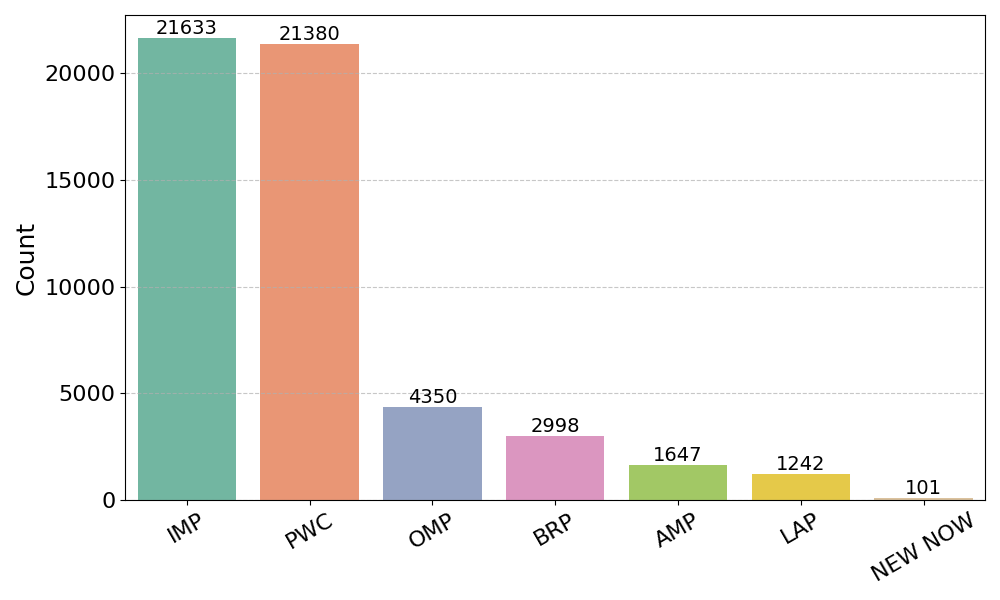

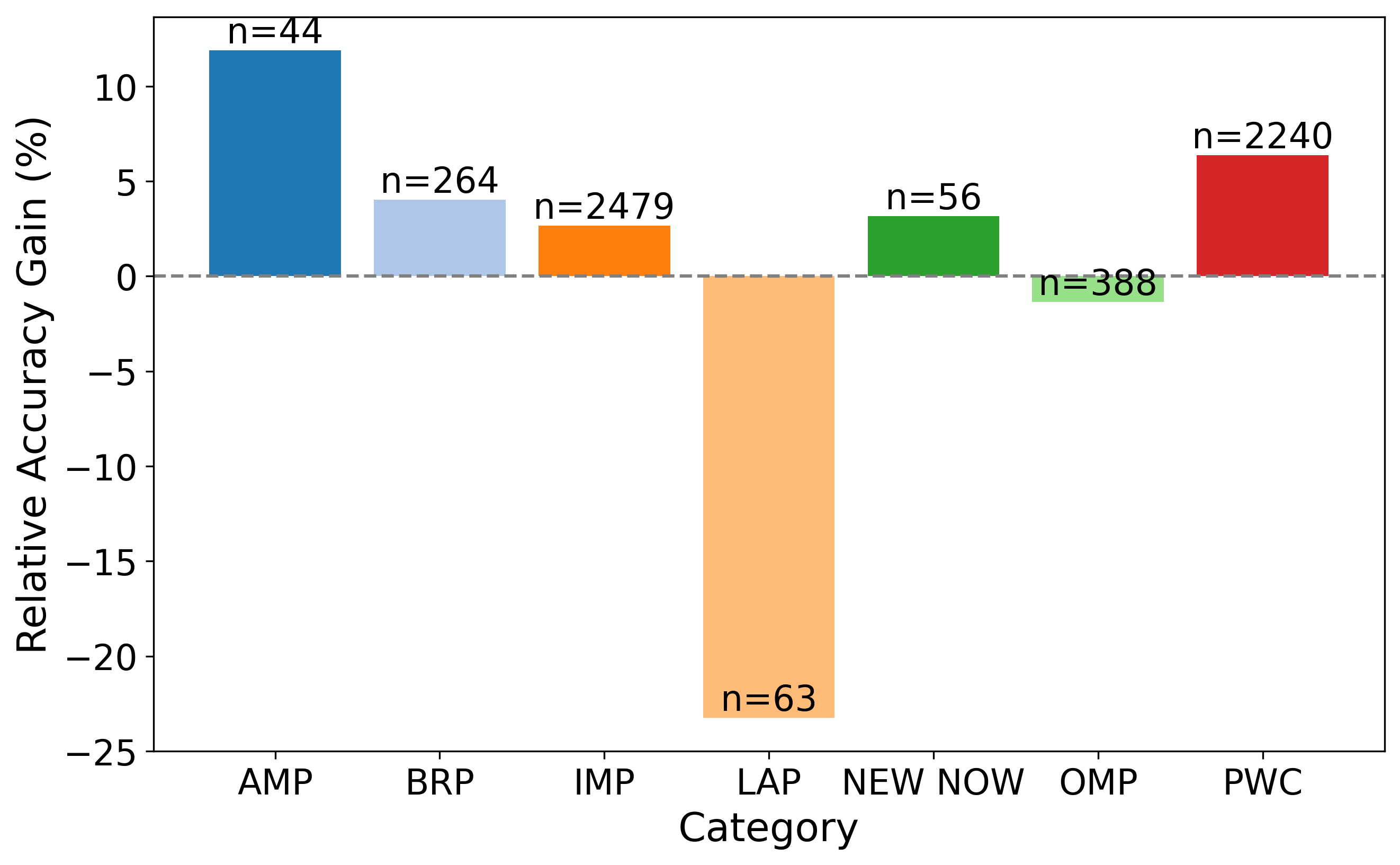

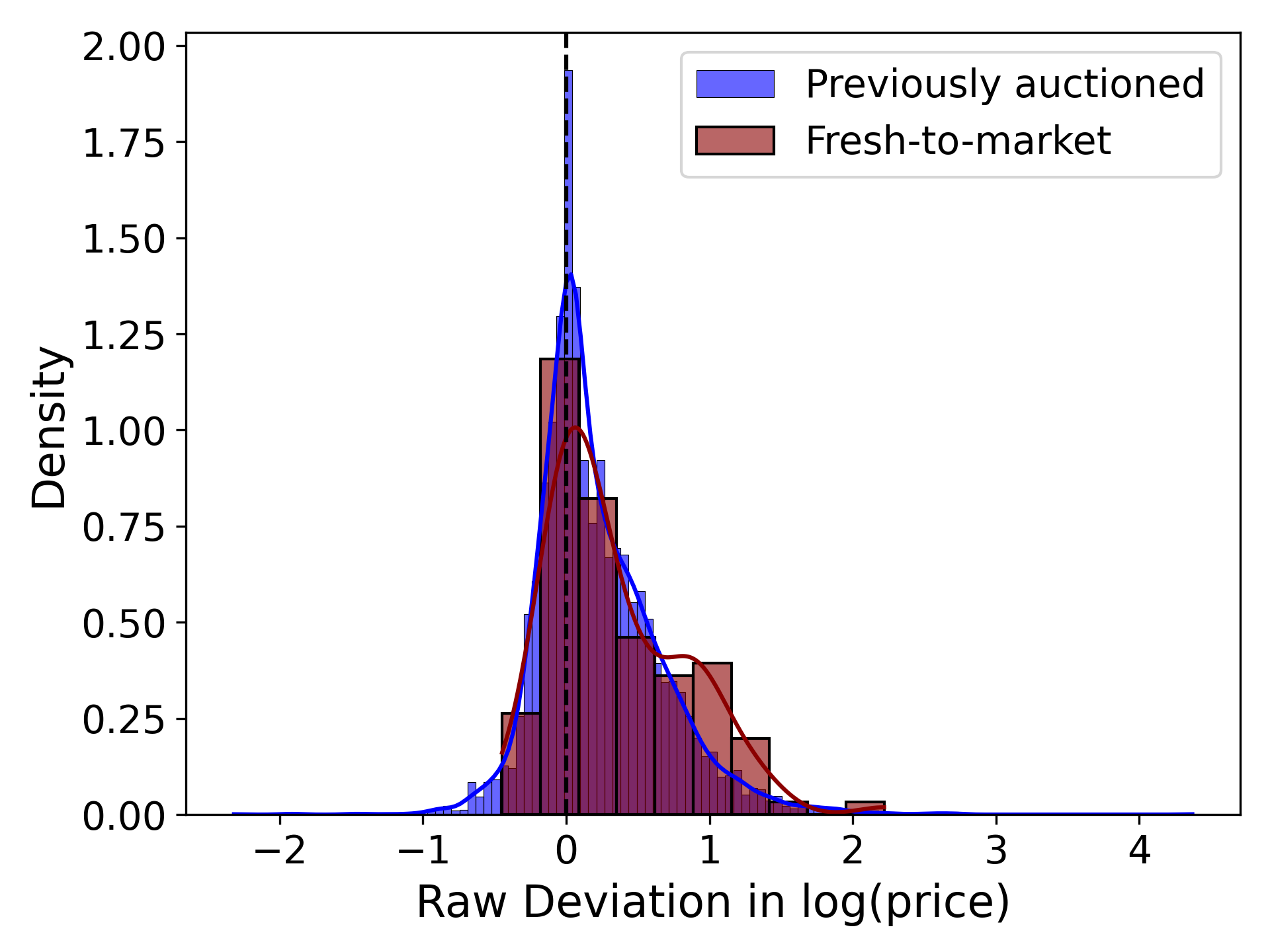

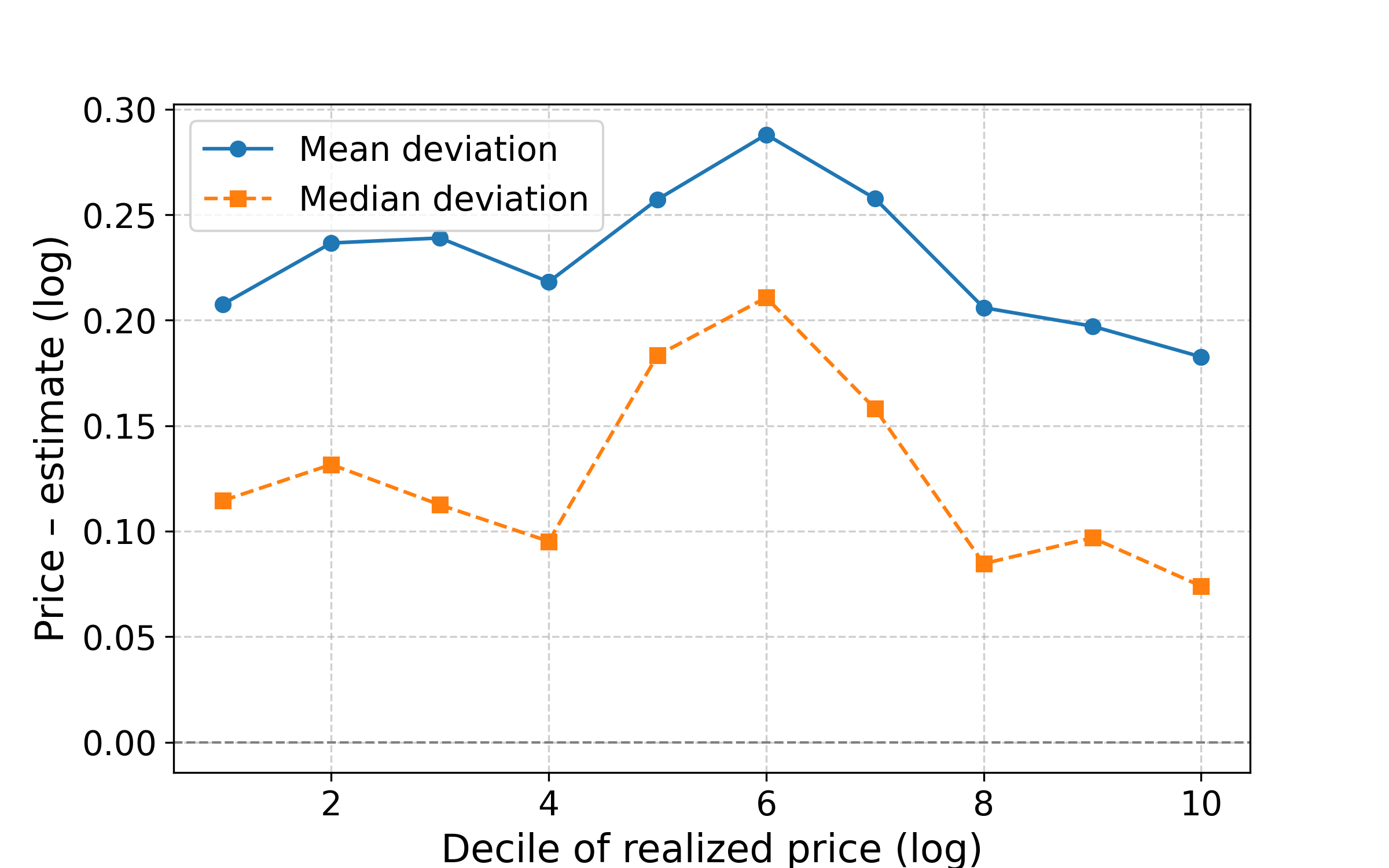

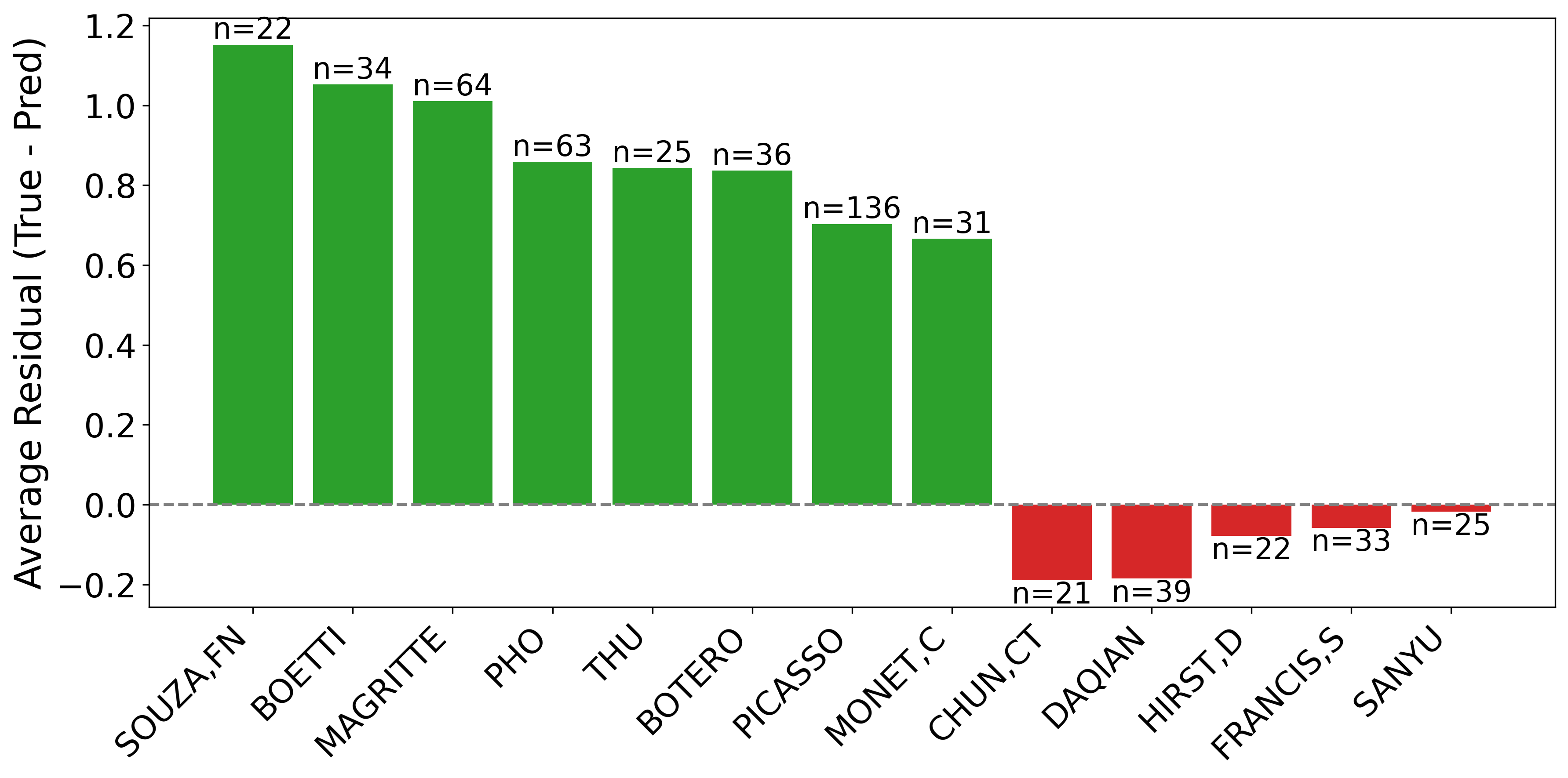

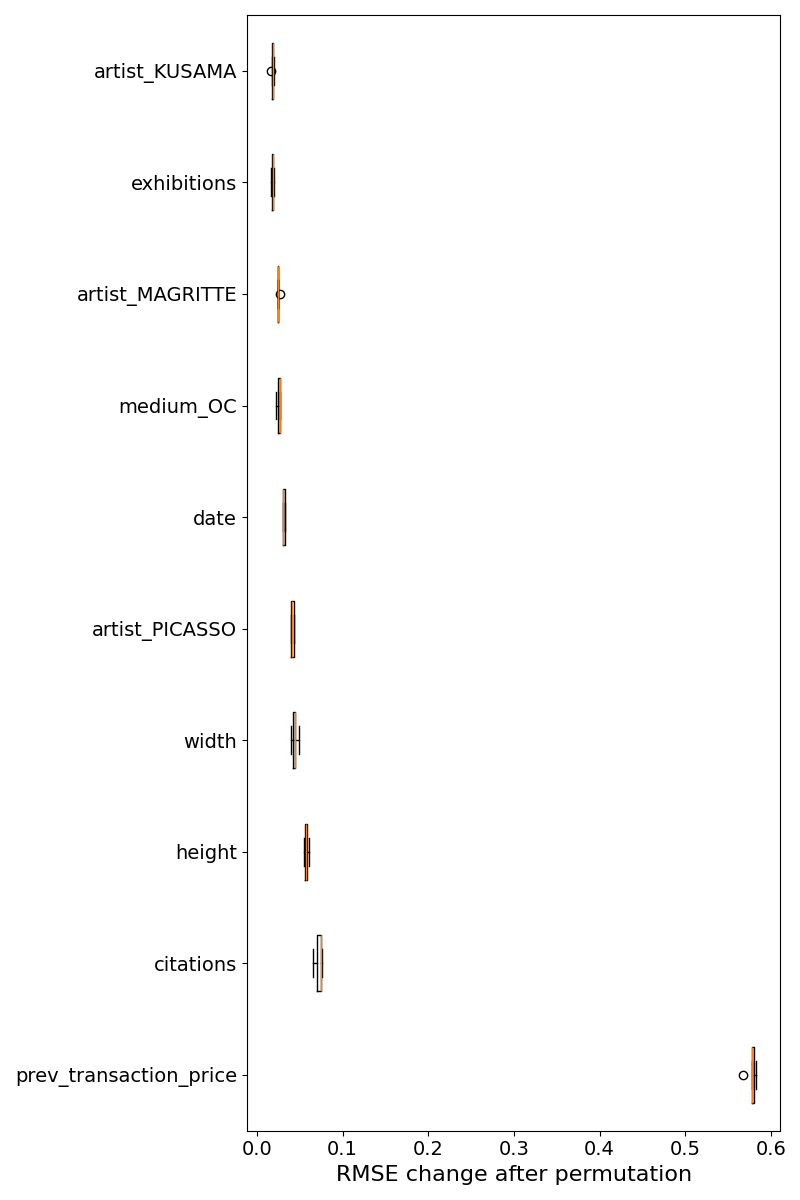

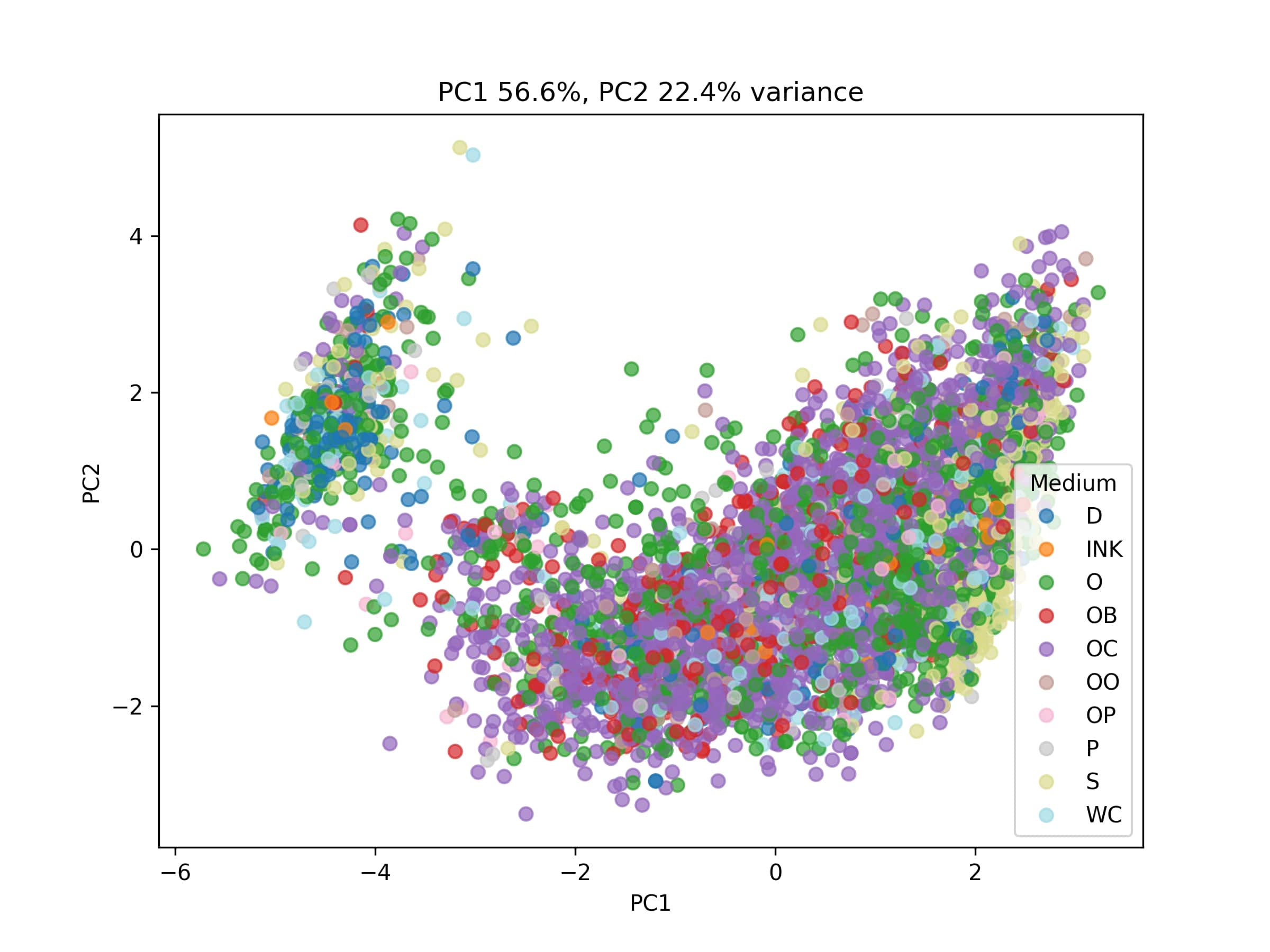

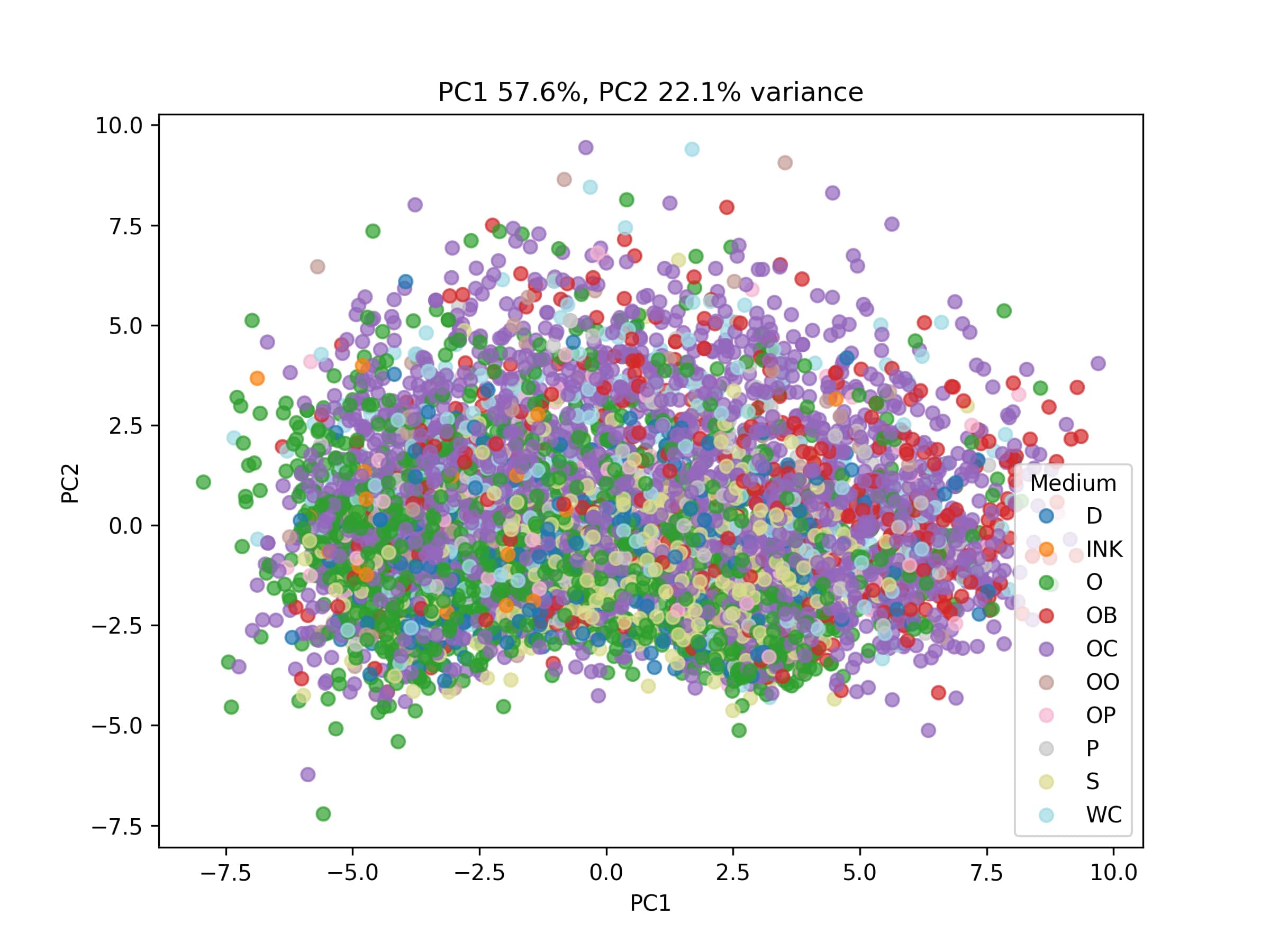

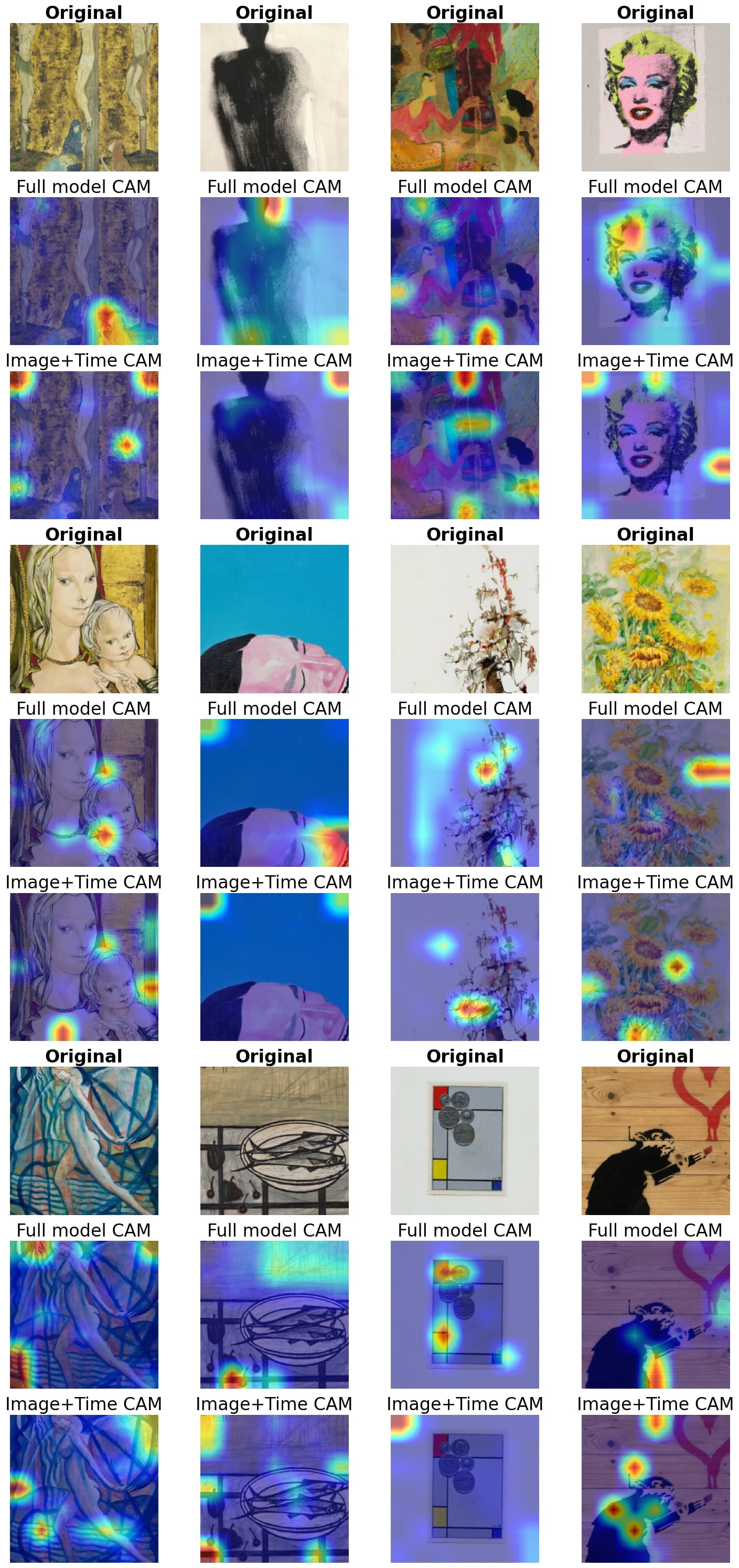

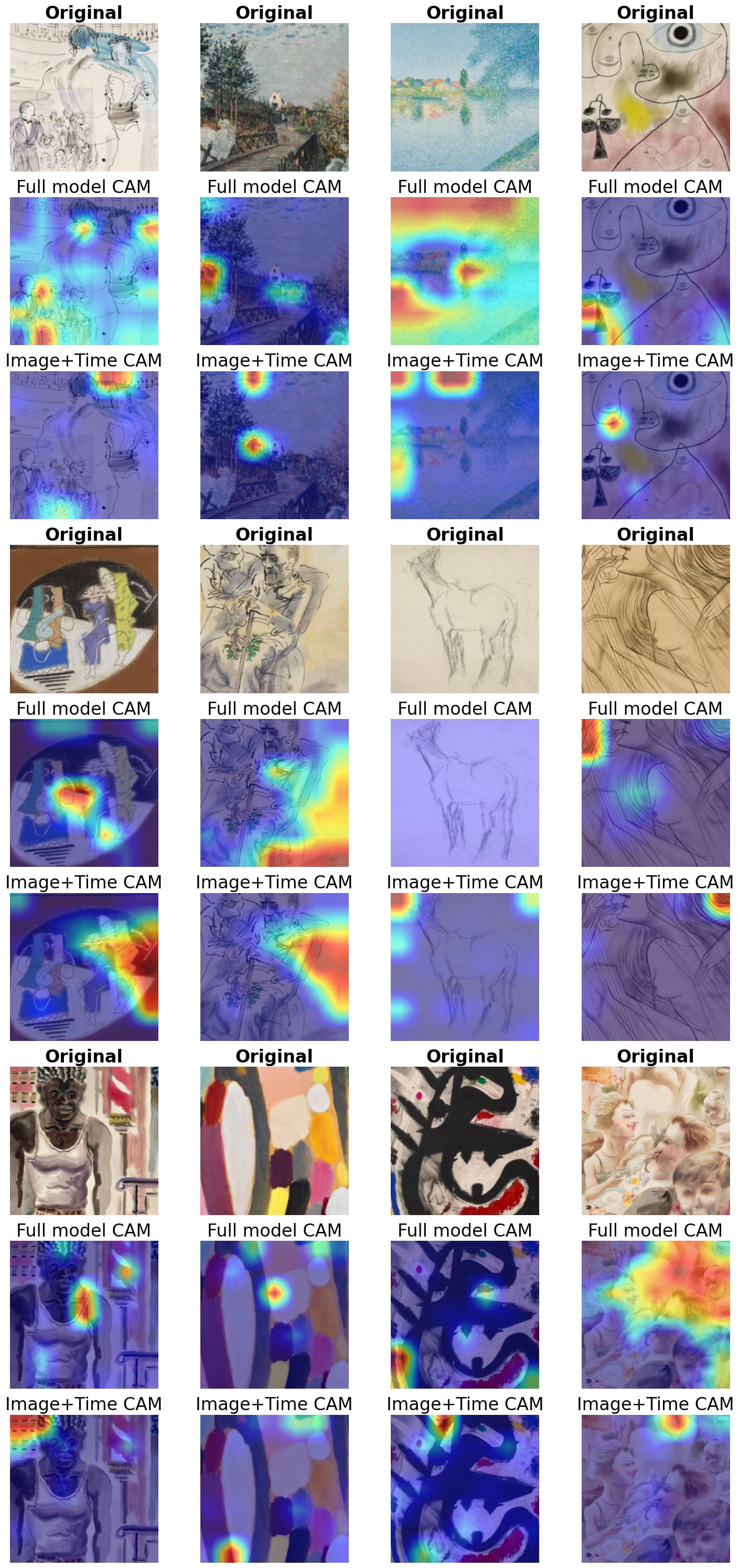

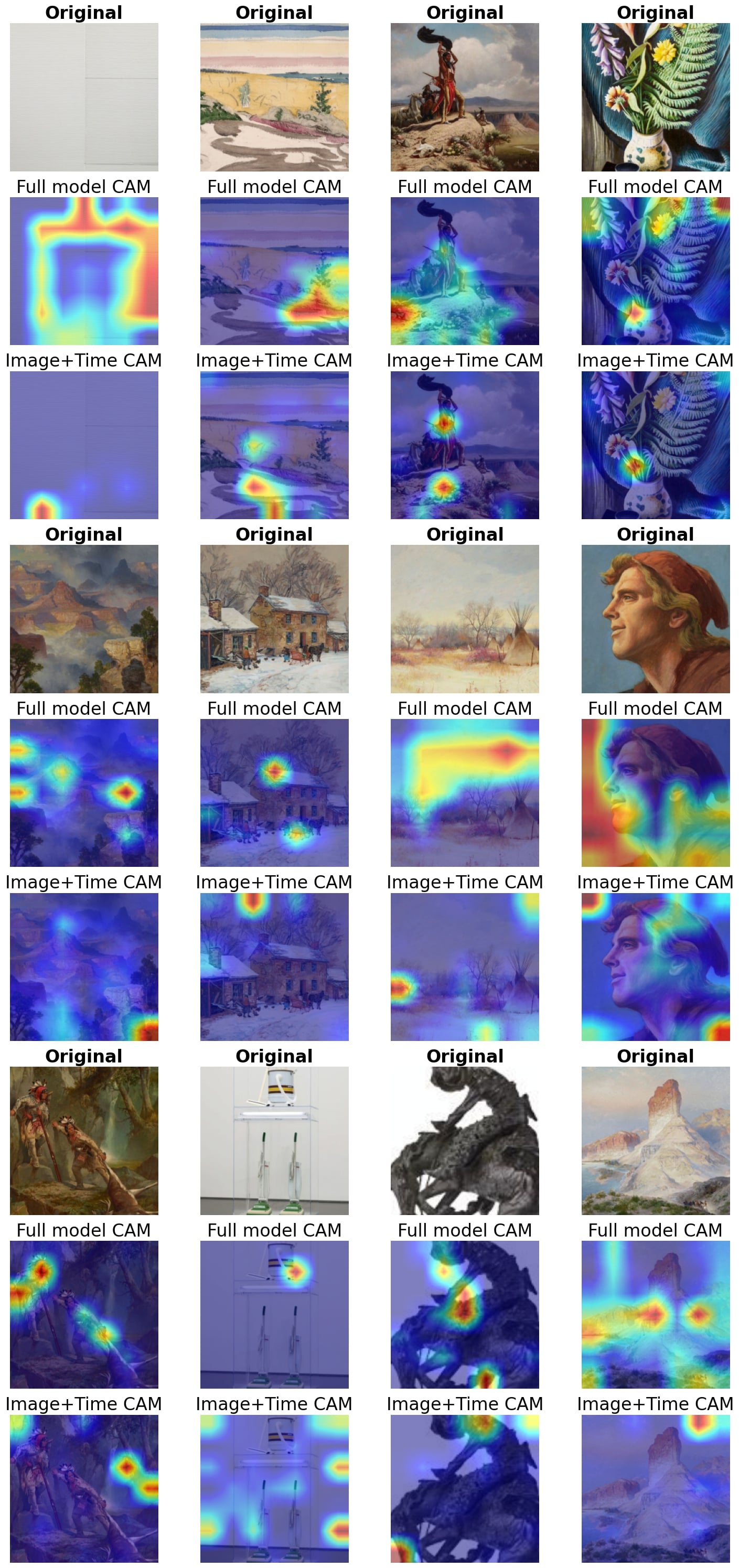

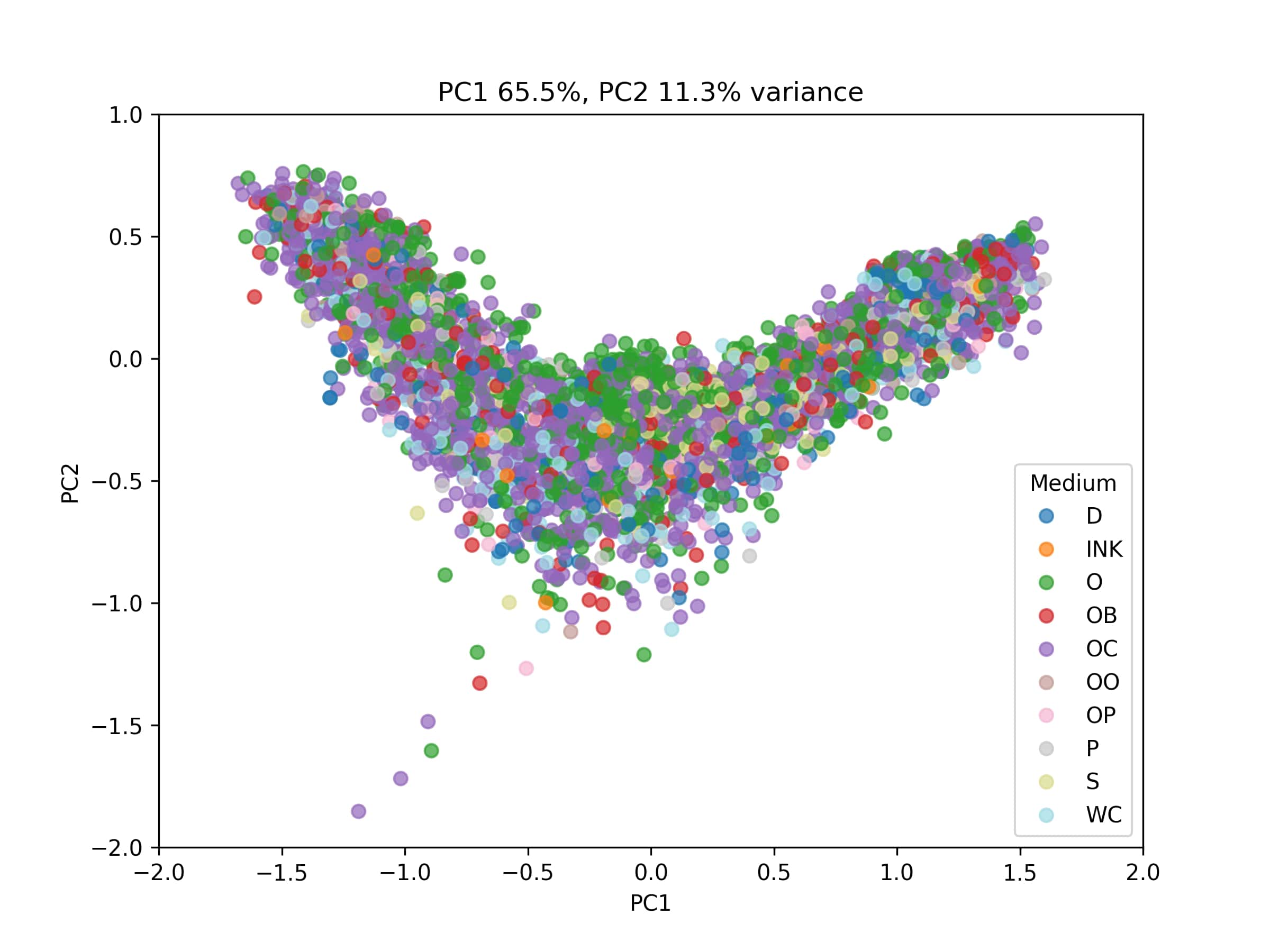

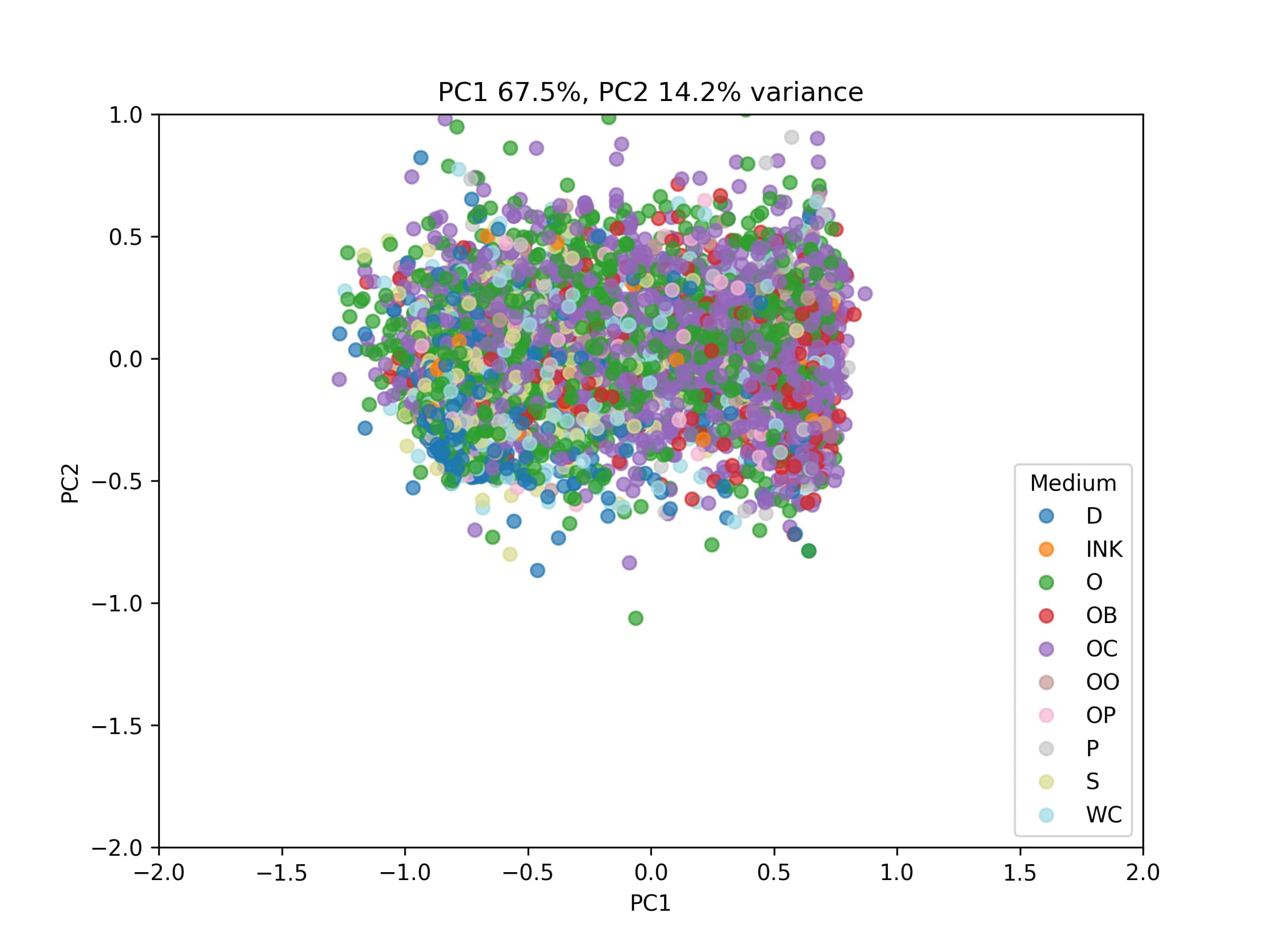

We study how deep learning can improve valuation in the art market by incorporating the visual content of artworks into predictive models. Using a large repeated-sales dataset from major auction houses, we benchmark classical hedonic regressions and tree-based methods against modern deep architectures, including multi-modal models that fuse tabular and image data. We find that while artist identity and prior transaction history dominate overall predictive power, visual embeddings provide a distinct and economically meaningful contribution for fresh-to-market works where historical anchors are absent. Interpretability analyses using Grad-CAM and embedding visualizations show that models attend to compositional and stylistic cues. Our findings demonstrate that multi-modal deep learning delivers significant value precisely when valuation is hardest, namely first-time sales, and thus offers new insights for both academic research and practice in art market valuation.💡 Summary & Analysis

1. **Theoretical Contribution**: This study provides a deep understanding of the core algorithms used for financial market predictions, akin to observing stars to predict weather. 2. **Practical Application**: Machine learning models are effectively applied to real stock market data, aiding investors in making better decisions, similar to how doctors analyze patient symptoms to prescribe appropriate treatments. 3. **Dataset Comparison**: By systematically comparing model performance across various datasets, the study identifies which algorithms work best under specific conditions, much like growing crops in different soils.Sci-Tube Style Script (Easy): To make financial market predictions more accurate, we can use machine learning algorithms. This helps us understand how stock prices move better.

Sci-Tube Style Script (Intermediate): The study emphasizes the role of machine learning in financial market prediction. Performance analysis across various datasets aids in identifying the most effective models under specific conditions.

Sci-Tube Style Script (Advanced): This study systematically analyzes methods to improve the accuracy of financial market predictions using machine learning algorithms, enabling model selection based on different environments.

📄 Full Paper Content (ArXiv Source)

📊 논문 시각자료 (Figures)