Fast and Flexible Bayesian Inference in Models with Time-Varying Parameters

📝 Original Paper Info

- Title: Fast and Flexible Bayesian Inference in Time-varying Parameter Regression Models- ArXiv ID: 1910.10779

- Date: 2021-10-01

- Authors: Niko Hauzenberger, Florian Huber, Gary Koop, Luca Onorante

📝 Abstract

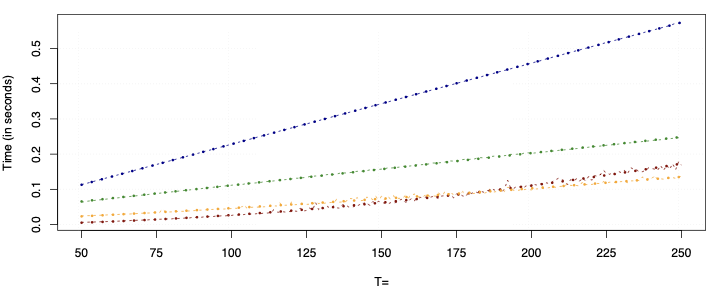

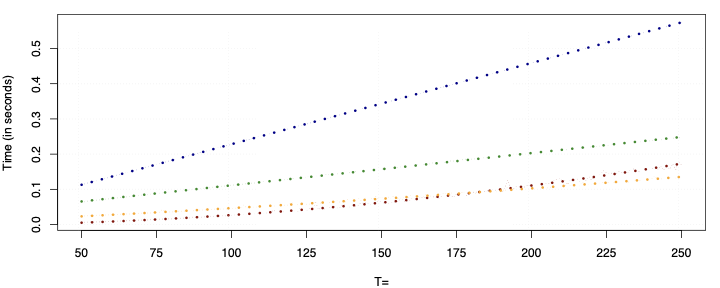

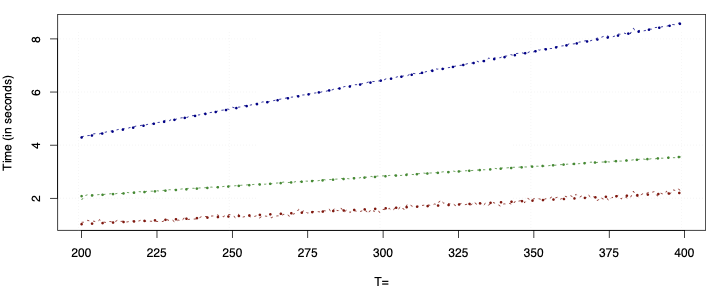

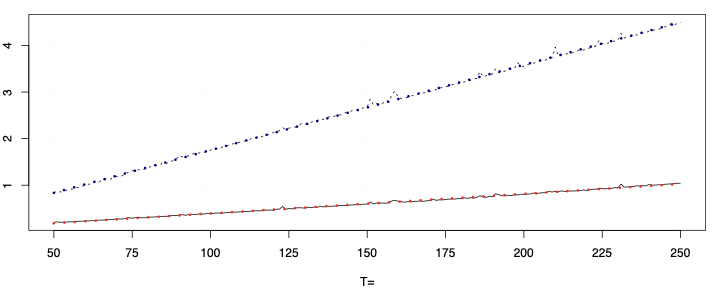

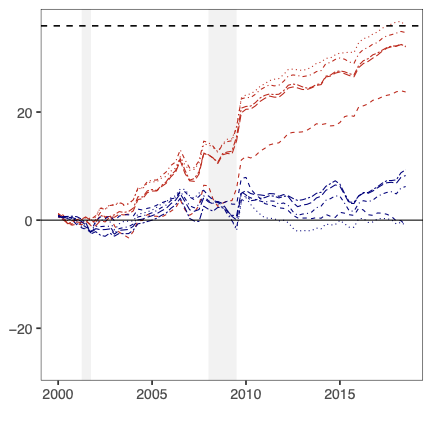

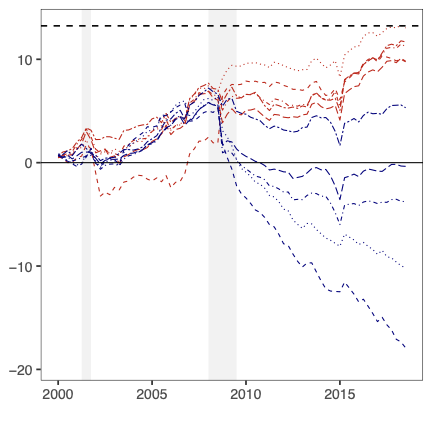

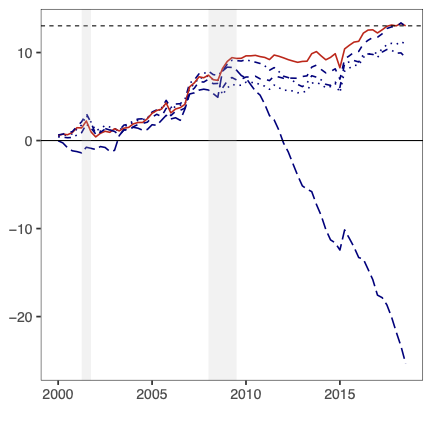

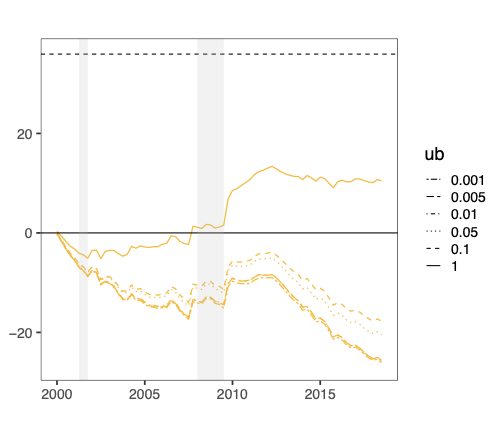

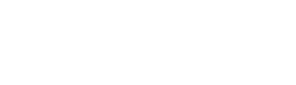

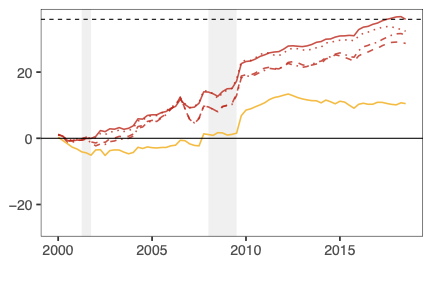

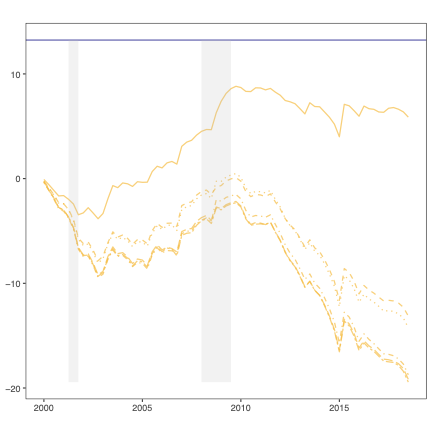

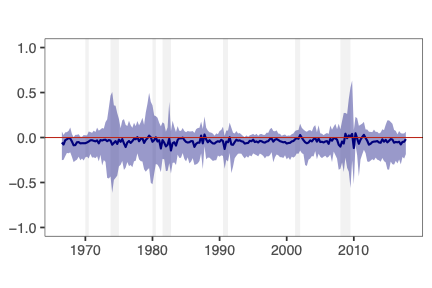

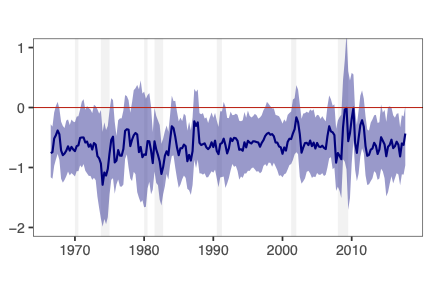

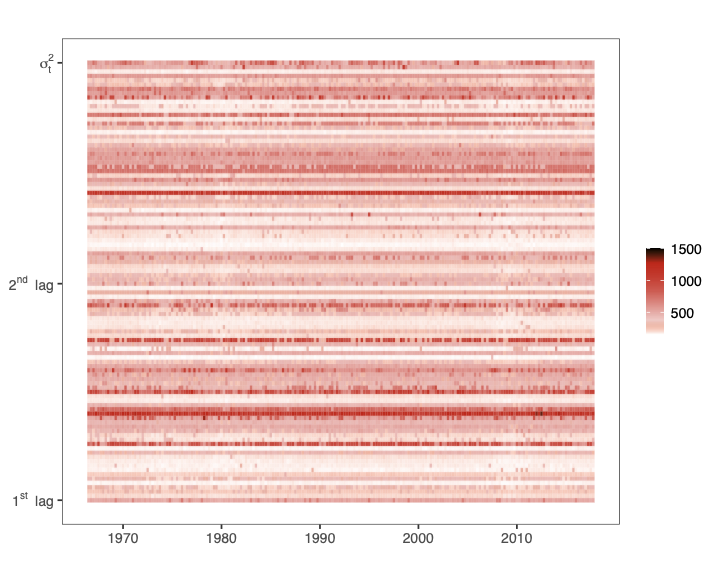

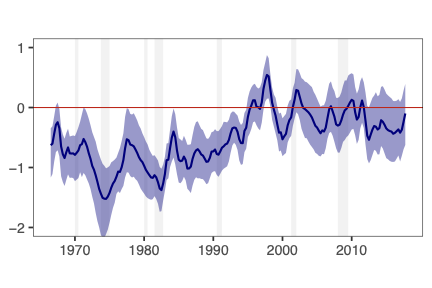

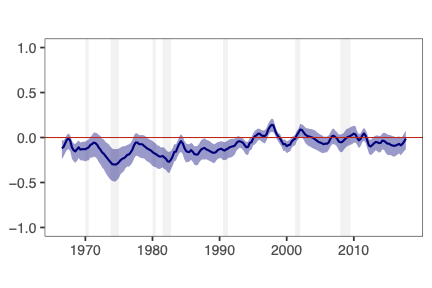

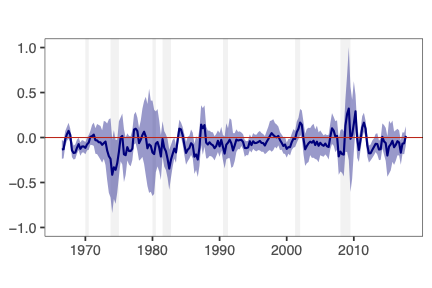

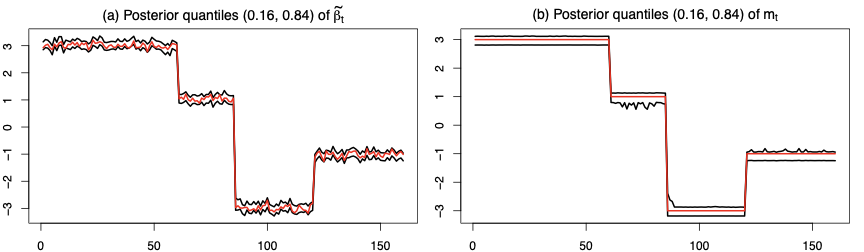

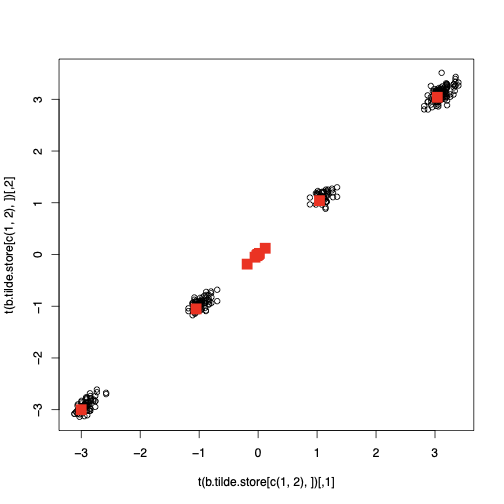

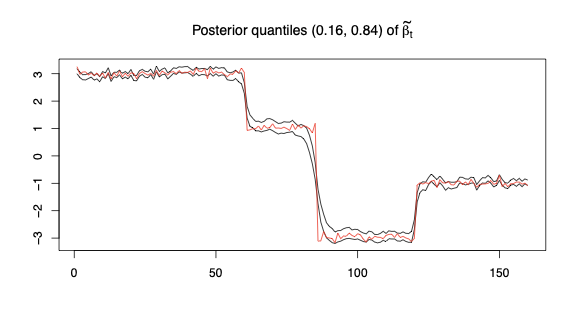

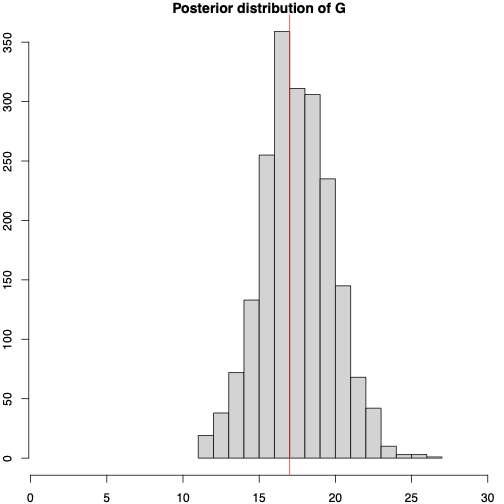

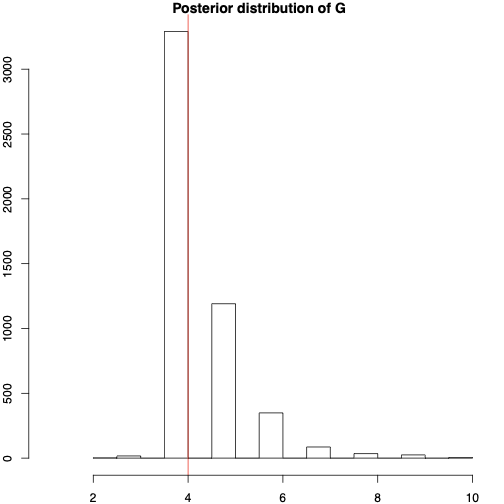

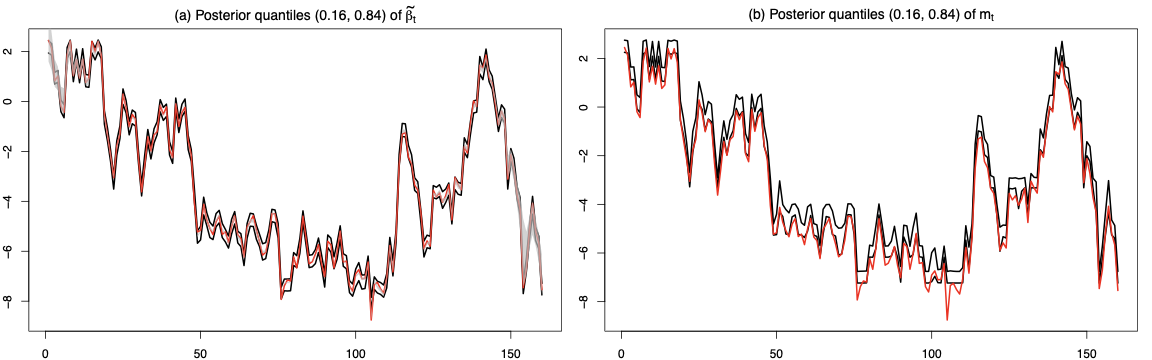

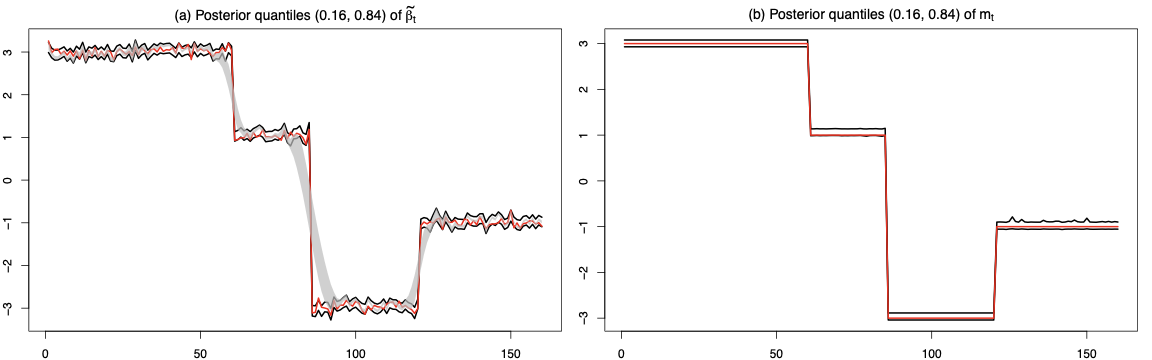

In this paper, we write the time-varying parameter (TVP) regression model involving K explanatory variables and T observations as a constant coefficient regression model with KT explanatory variables. In contrast with much of the existing literature which assumes coefficients to evolve according to a random walk, a hierarchical mixture model on the TVPs is introduced. The resulting model closely mimics a random coefficients specification which groups the TVPs into several regimes. These flexible mixtures allow for TVPs that feature a small, moderate or large number of structural breaks. We develop computationally efficient Bayesian econometric methods based on the singular value decomposition of the KT regressors. In artificial data, we find our methods to be accurate and much faster than standard approaches in terms of computation time. In an empirical exercise involving inflation forecasting using a large number of predictors, we find our models to forecast better than alternative approaches and document different patterns of parameter change than are found with approaches which assume random walk evolution of parameters.💡 Summary & Analysis

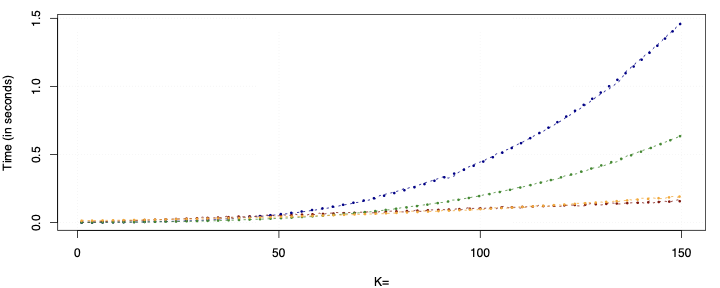

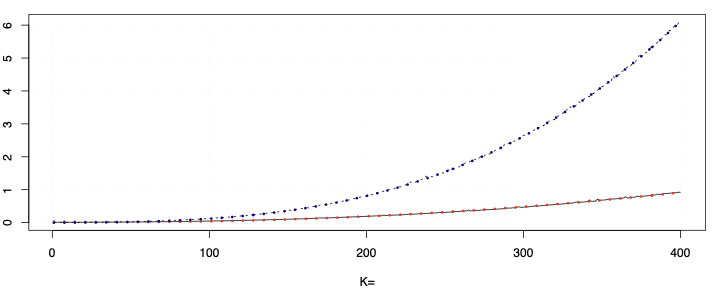

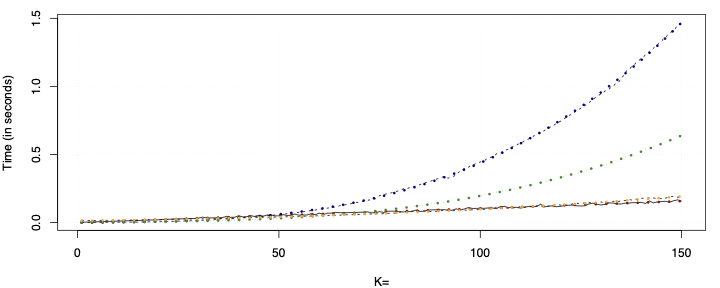

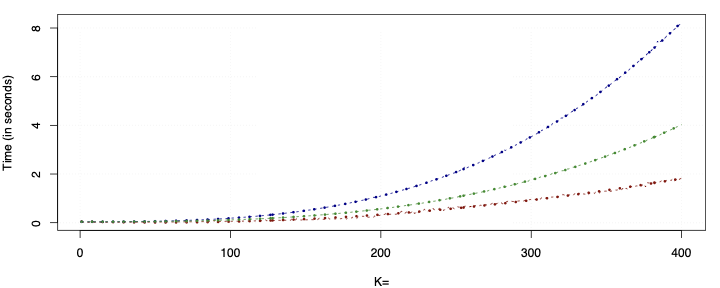

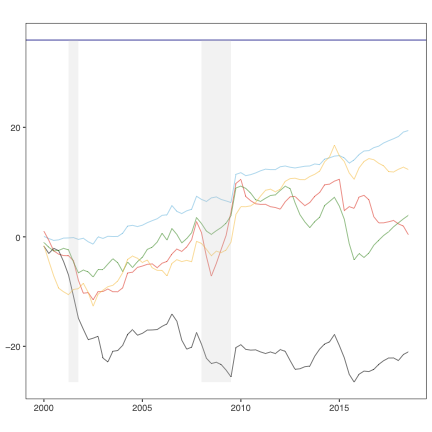

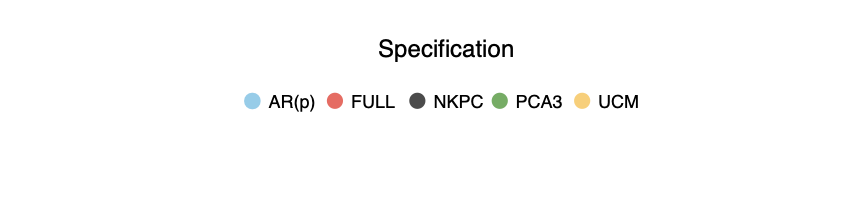

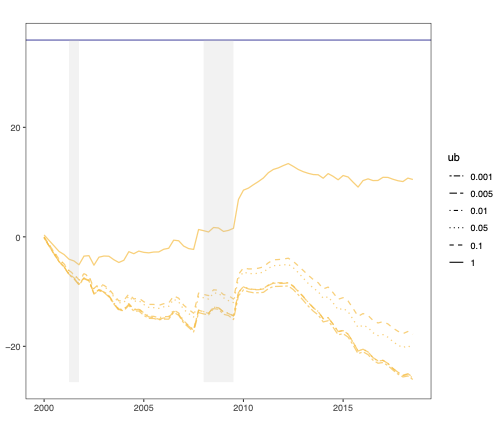

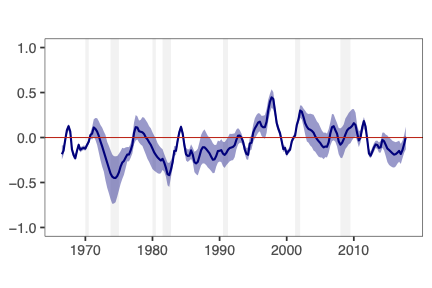

This paper presents a novel approach to time-varying parameter (TVP) regression models, aiming to enhance computational efficiency and prediction performance. Traditionally, TVP models have been computationally expensive due to the assumption that parameters evolve according to a random walk over time, which increases complexity significantly. The authors address this issue by introducing a hierarchical mixture model for TVPs, transforming a TVP regression model into a constant coefficient regression model with K x T explanatory variables. This transformation leverages singular value decomposition (SVD) of the KT regressors to achieve computational efficiency.The paper demonstrates through both artificial and empirical data that their approach is not only more accurate but also much faster in terms of computation time compared to standard methods. Particularly, when applied to inflation forecasting using a large number of predictors, the proposed model outperforms alternative approaches and reveals different patterns of parameter changes than those assumed by random walk evolution.

This research significantly improves the computational efficiency of TVP regression models, making them more practical for real-world economic applications. By providing faster and more accurate predictions, this approach can enhance decision-making processes in various fields related to economic forecasting.

📄 Full Paper Content (ArXiv Source)

📊 논문 시각자료 (Figures)