Storage or No Storage Duopoly Competition Among Renewable Energy Suppliers in a Local Market

📝 Original Paper Info

- Title: Storage or No Storage Duopoly Competition Between Renewable Energy Suppliers in a Local Energy Market- ArXiv ID: 1910.02744

- Date: 2019-10-15

- Authors: Dongwei Zhao, Hao Wang, Jianwei Huang, Xiaojun Lin

📝 Abstract

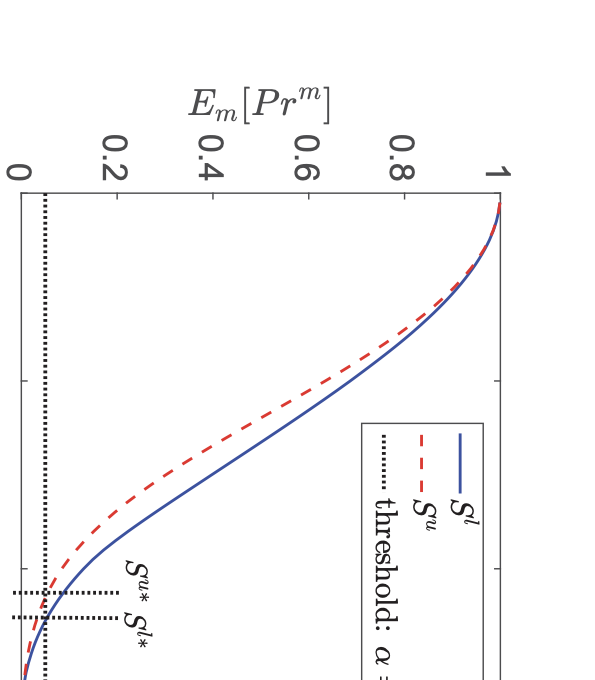

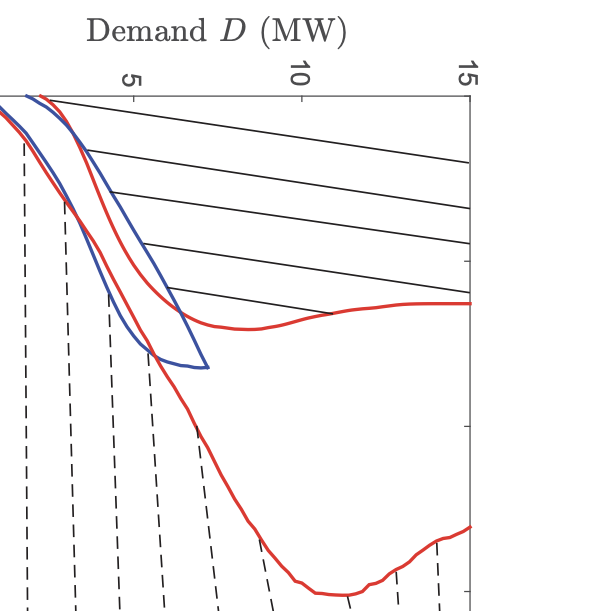

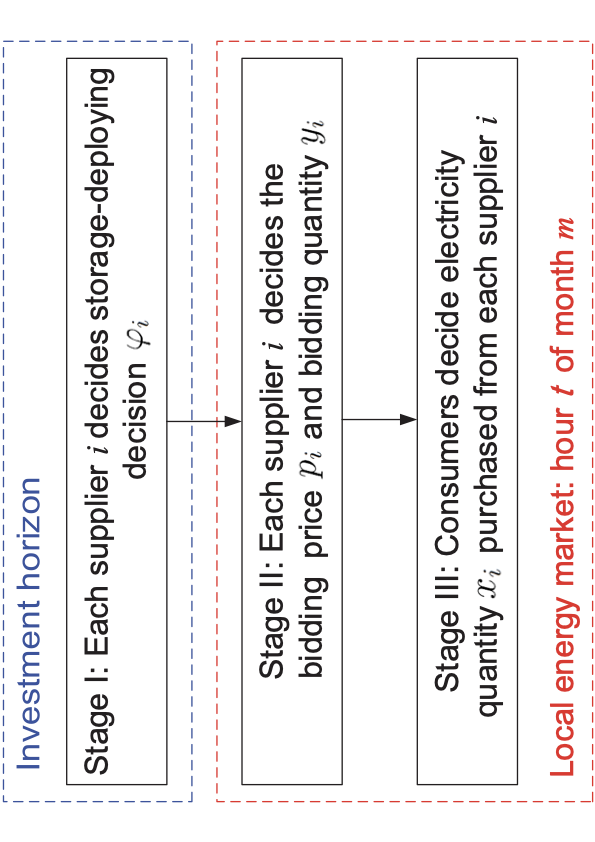

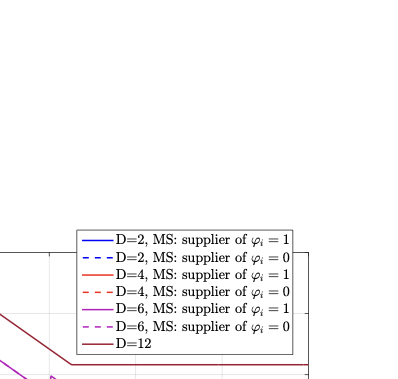

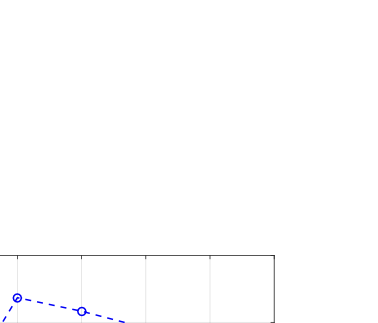

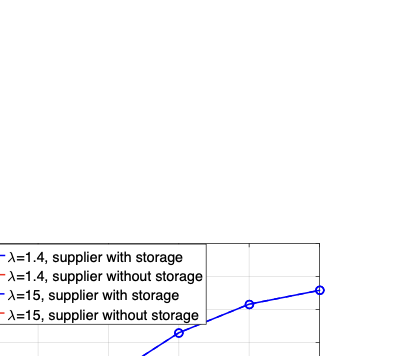

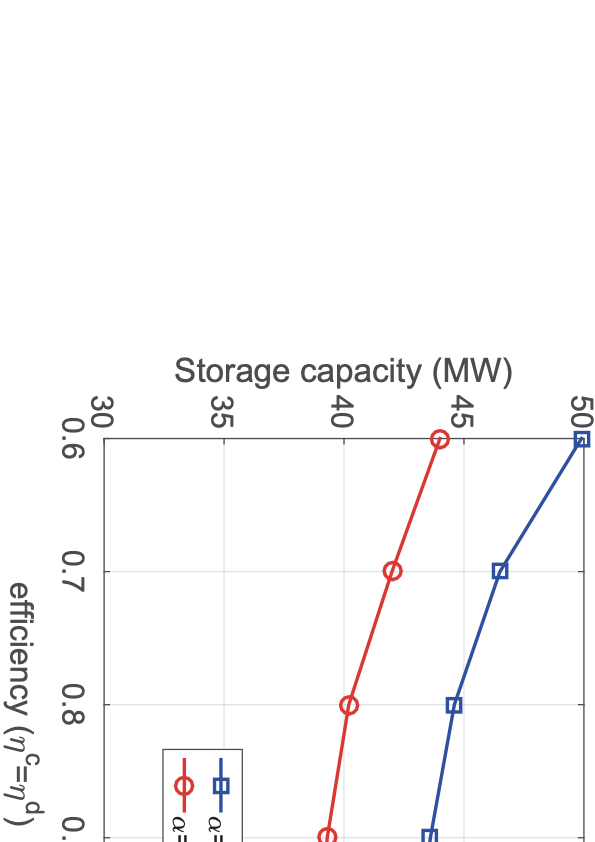

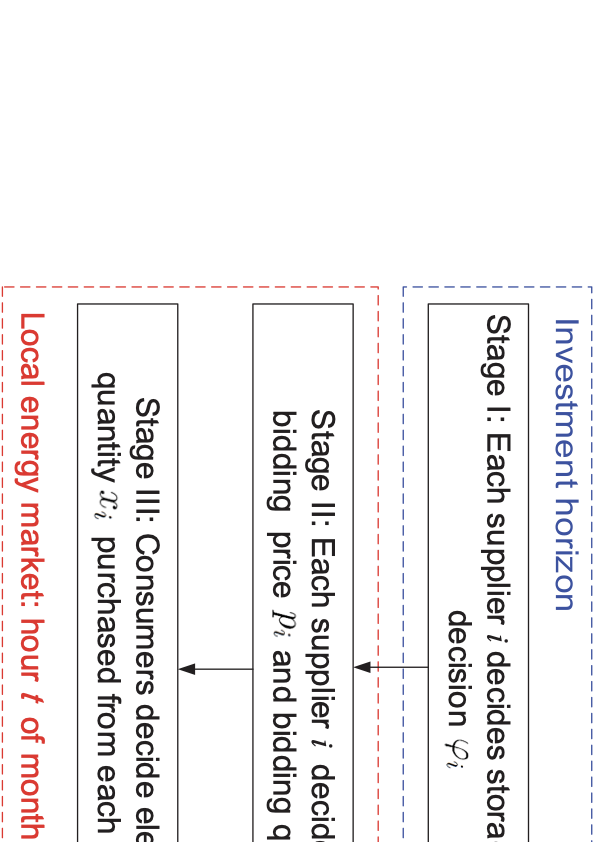

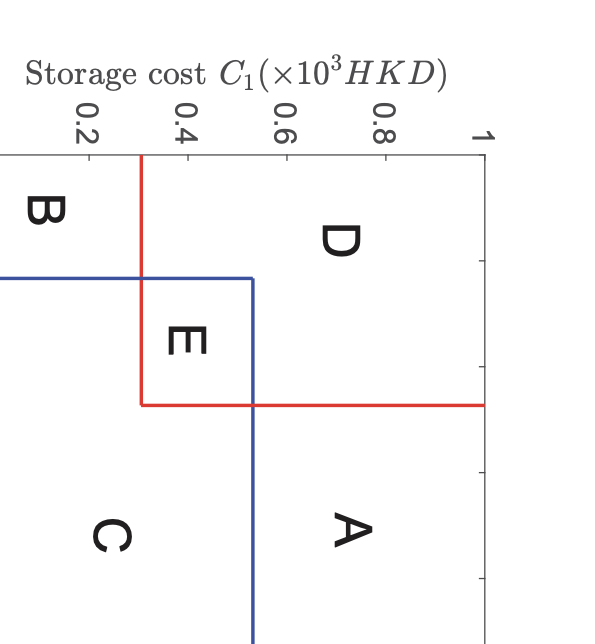

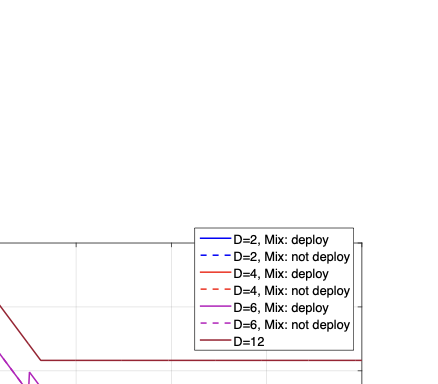

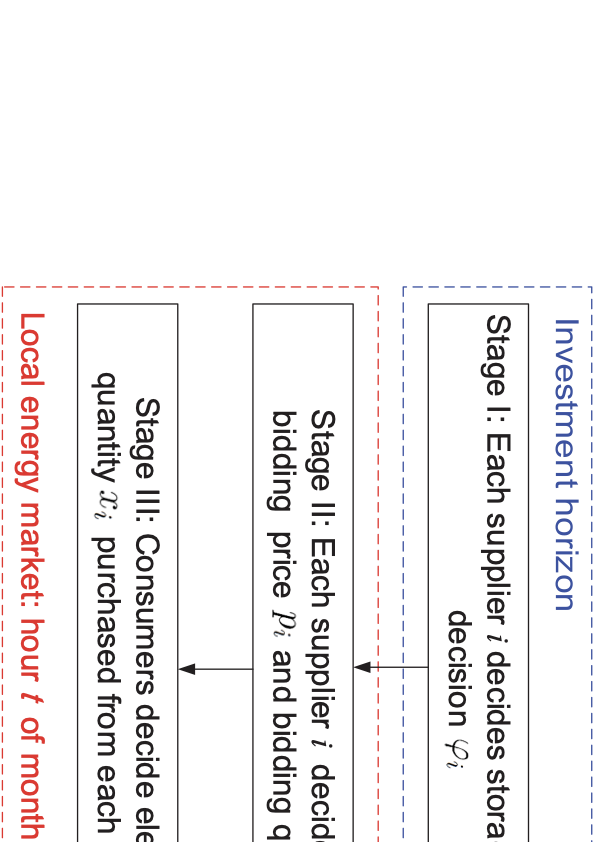

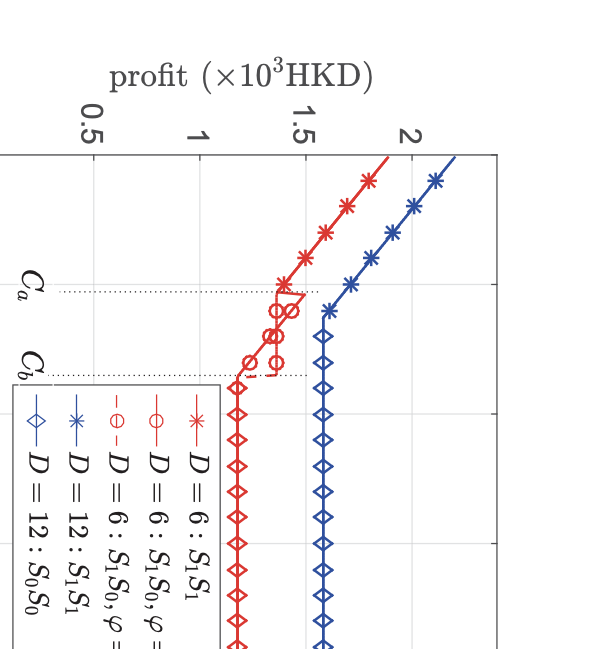

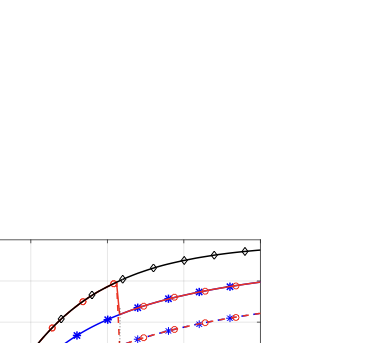

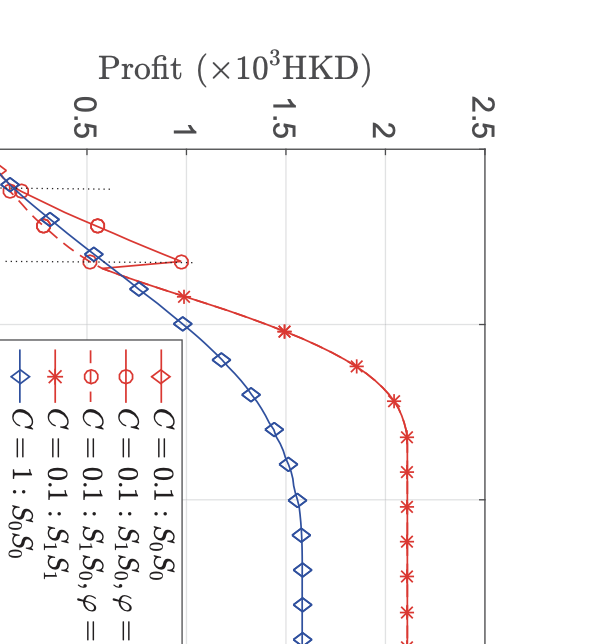

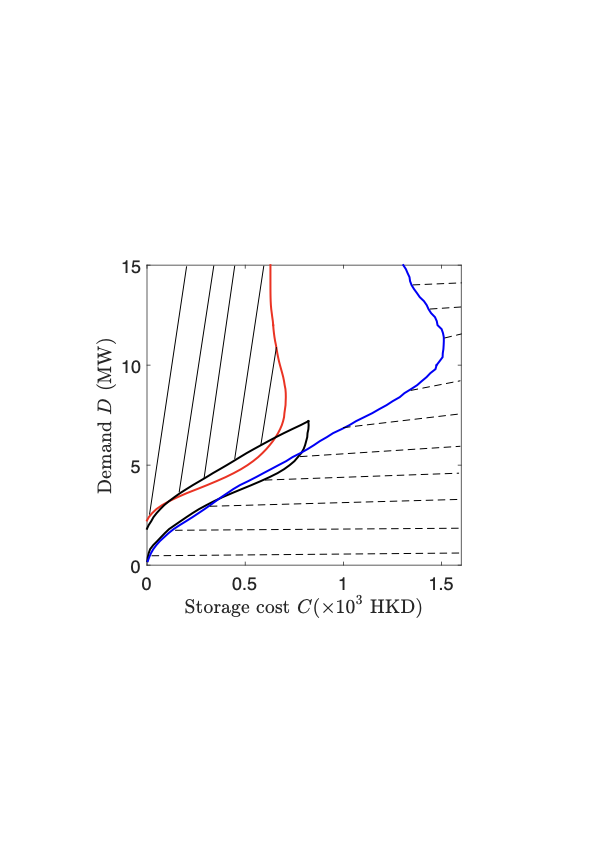

This paper studies the duopoly competition between renewable energy suppliers with or without energy storage in a local energy market. The storage investment brings the benefits of stabilizing renewable energy suppliers' outputs, but it also leads to substantial investment costs as well as some surprising changes in the market outcome. To study the equilibrium decisions of storage investment in the renewable energy suppliers' competition, we model the interactions between suppliers and consumers using a three-stage game-theoretic model. In Stage I, at the beginning of the investment horizon, suppliers decide whether to invest in storage. Once such decisions have been made, in the day-ahead market of each day, suppliers decide on their bidding prices and quantities in Stage II, based on which consumers decide the electricity quantity purchased from each supplier in Stage III. In the real-time market, a supplier is penalized if his actual generation falls short of his commitment. We characterize a price-quantity competition equilibrium of Stage II, and we further characterize a storage-investment equilibrium in Stage I incorporating electricity-selling revenue and storage cost. Counter-intuitively, we show that the uncertainty of renewable energy without storage investment can lead to higher supplier profits compared with the stable generations with storage investment due to the reduced market competition under random energy generation. Simulations further illustrate results due to the market competition. For example, a higher penalty for not meeting the commitment, a higher storage cost, or a lower consumer demand can sometimes increase a supplier's profit. We also show that although storage investment can increase a supplier 's profit, the first-mover supplier who invests in storage may benefit less than the free-rider competitor who chooses not to invest.💡 Summary & Analysis

This paper explores the duopoly competition between renewable energy suppliers in a local market, focusing on whether to invest in energy storage or not. The study reveals that while energy storage can stabilize output from renewable sources, it also comes with significant investment costs and unexpected changes in market outcomes. Using a three-stage game-theoretic model, researchers analyze the interactions among suppliers and consumers. In Stage I, suppliers decide about storage investments; in Stage II, they set bidding prices and quantities for daily markets; and in Stage III, consumers choose electricity from each supplier based on these bids. The study finds that counterintuitively, the uncertainty of renewable energy without storage investment can lead to higher profits for suppliers due to reduced competition under random generation conditions. Simulations demonstrate that factors like higher penalties for non-compliance with commitments or lower consumer demand can increase a supplier's profit despite high storage costs. This research provides important insights for renewable energy suppliers and policymakers, highlighting the complex interplay between market dynamics and technology investment decisions.📄 Full Paper Content (ArXiv Source)

📊 논문 시각자료 (Figures)