LLM Collusion

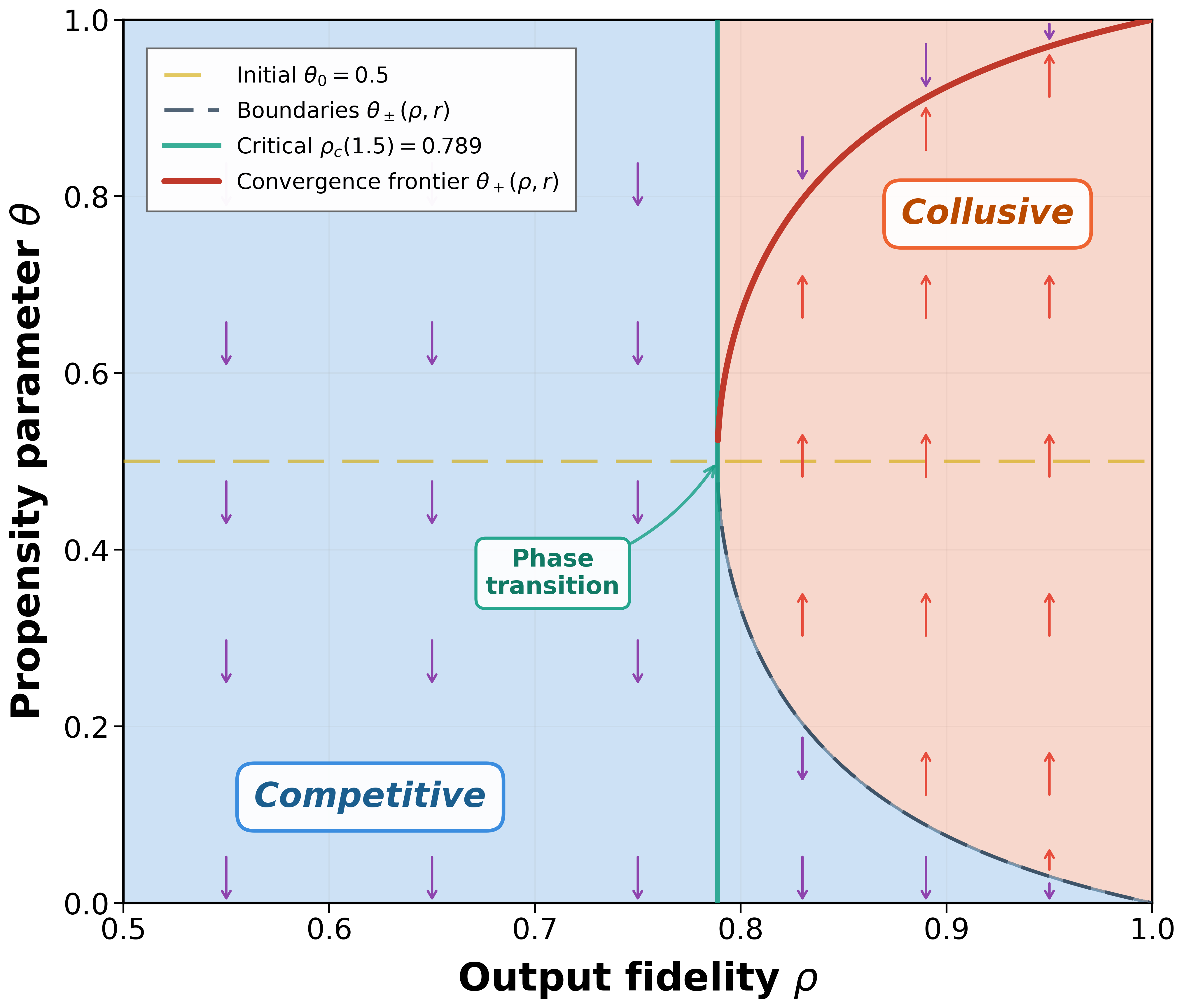

We study how delegating pricing to large language models (LLMs) can facilitate collusion in a duopoly when both sellers rely on the same pre-trained model. The LLM is characterized by (i) a propensity parameter capturing its internal bias toward high-price recommendations and (ii) an output-fidelity parameter measuring how tightly outputs track that bias; the propensity evolves through retraining. We show that configuring LLMs for robustness and reproducibility can induce collusion via a phase transition there exists a critical output-fidelity threshold that pins down long-run behavior. Below it, competitive pricing is the unique long-run outcome. Above it, the system is bistable, with competitive and collusive pricing both locally stable and the realized outcome determined by the model s initial preference. The collusive regime resembles tacit collusion prices are elevated on average, yet occasional low-price recommendations provide plausible deniability. With perfect fidelity, full collusion emerges from any interior initial condition. For finite training batches of size $b$, infrequent retraining (driven by computational costs) further amplifies collusion conditional on starting in the collusive basin, the probability of collusion approaches one as $b$ grows, since larger batches dampen stochastic fluctuations that might otherwise tip the system toward competition. The indeterminacy region shrinks at rate $O(1/ sqrt{b})$.