H3M-SSMoEs: Hypergraph-based Multimodal Learning with LLM Reasoning and Style-Structured Mixture of Experts

📝 Original Info

- Title: H3M-SSMoEs: Hypergraph-based Multimodal Learning with LLM Reasoning and Style-Structured Mixture of Experts

- ArXiv ID: 2510.25091

- Date: 2025-10-29

- Authors: 논문에 명시된 저자 정보가 제공되지 않았습니다.

📝 Abstract

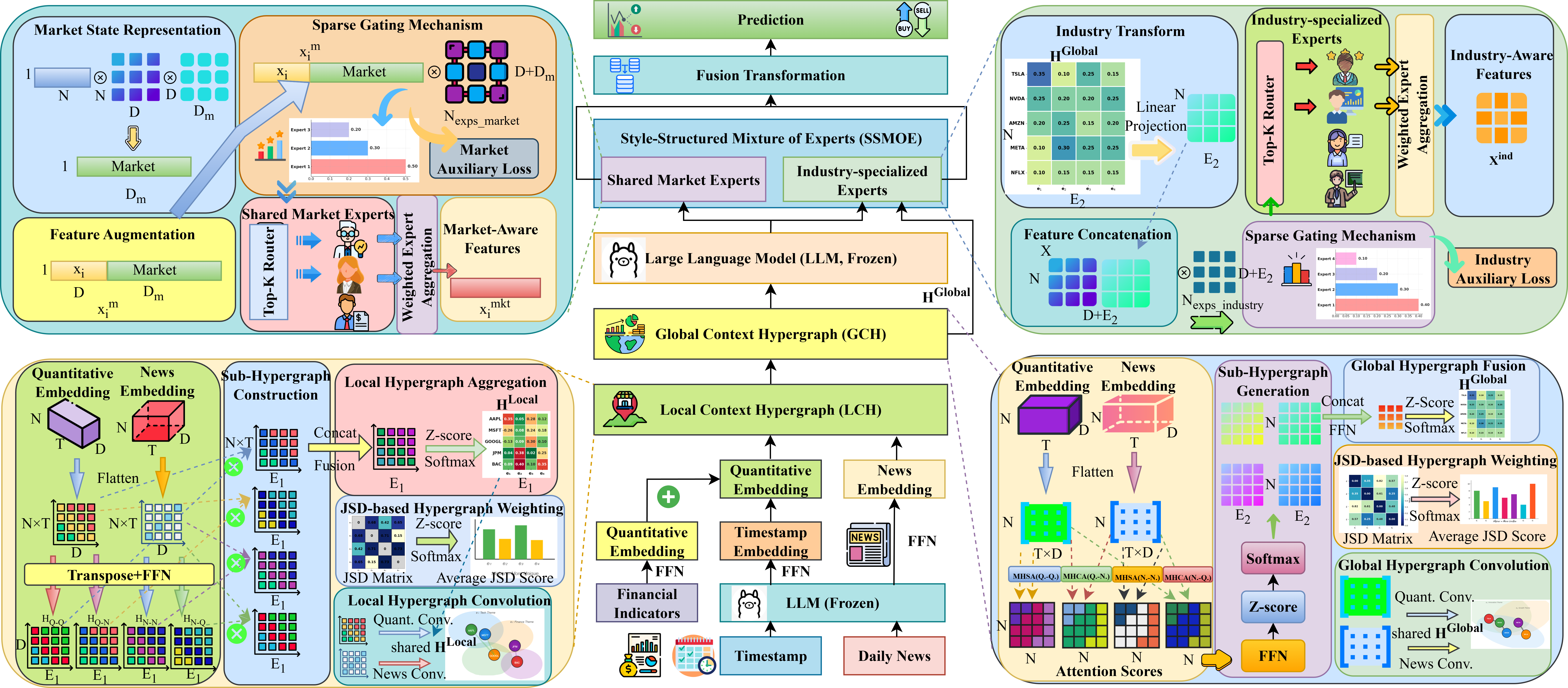

Stock movement prediction remains fundamentally challenging due to complex temporal dependencies, heterogeneous modalities, and dynamically evolving inter-stock relationships. Existing approaches often fail to unify structural, semantic, and regime-adaptive modeling within a scalable framework. This work introduces H3M-SSMoEs, a novel Hypergraph-based MultiModal architecture with LLM reasoning and Style-Structured Mixture of Experts, integrating three key innovations: (1) a Multi-Context Multimodal Hypergraph that hierarchically captures fine-grained spatiotemporal dynamics via a Local Context Hypergraph (LCH) and persistent inter-stock dependencies through a Global Context Hypergraph (GCH), employing shared cross-modal hyperedges and Jensen-Shannon Divergence weighting mechanism for adaptive relational learning and cross-modal alignment; (2) a LLM-enhanced reasoning module, which leverages a frozen large language model with lightweight adapters to semantically fuse and align quantitative and textual modalities, enriching representations with domain-specific financial knowledge; and (3) a Style-Structured Mixture of Experts (SSMoEs) that combines shared market experts and industry-specialized experts, each parameterized by learnable style vectors enabling regime-aware specialization under sparse activation. Extensive experiments on three major stock markets demonstrate that H3M-SSMoEs surpasses state-of-the-art methods in both superior predictive accuracy and investment performance, while exhibiting effective risk control. Datasets, source code, and model weights are available at our GitHub repository: https://github.com/PeilinTime/H3M-SSMoEs.💡 Deep Analysis

📄 Full Content

📸 Image Gallery

Reference

This content is AI-processed based on open access ArXiv data.